The True Costs of Owning a Home Can Top $14K Annually

Tallying all the costs involved in home ownership can give you a truer picture of affordability. Here’s what you need to know to plan your budget.

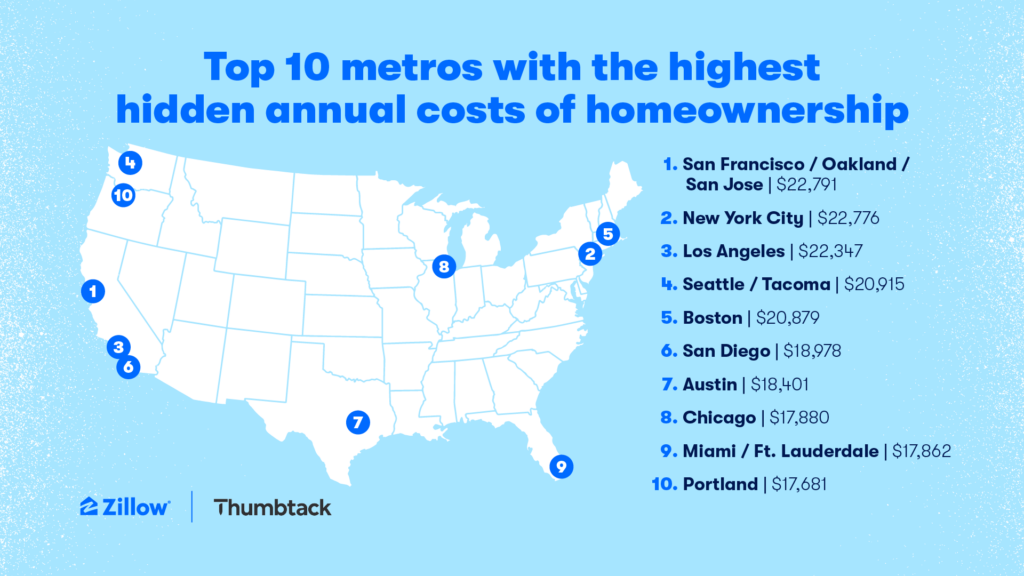

The best time to get a sense of the costs involved in home ownership is before you begin to look for one, especially since the “hidden costs” of owning a home can top $14,000 a year for the average U.S. homeowner and exceed $22,000 in pricey metros such as San Francisco and New York.

The sum — which pencils out to $1,180 a month for the average homeowner — includes utility bills, homeowners insurance and maintenance costs, according to an analysis by Zillow and Thumbtack, a home management platform that enables people to fix, maintain and improve their homes.

While most prospective buyers are familiar with big ticket items such as mortgage payments and property taxes, smaller costs add to the cost of owning a home. Taking them into account before you begin shopping can help prevent unpleasant surprises that strain or drain your finances.

What are the costs of owning a home?

“Understanding all the costs that come with homeownership can not only impact a buyer’s budget, but the type of home they shop for, too,” said Zillow® home trends expert Amanda Pendleton. “While a big backyard or a larger home may be appealing, it’s important to consider how much maintaining those spaces could cost. Buyers may want to consider affordable alternatives to single-family homes, or spend more upfront on a new-construction home that could need less maintenance in the near term.”

The total costs of home ownership are made up of purchase costs, ongoing fixed costs and maintenance expenses. The most common ongoing expenses include:

- Mortgage payments (principal and interest)

- Property taxes

- Insurance

- HOA dues (if applicable)

- Utilities

- Maintenance

Costs of homeownership by location

Of the top 39 metro areas analyzed, the locations with the highest hidden costs of ownership costs are San Francisco, New York and Los Angeles, which all came in at more than $22,000 annually.

Locations with some of the least expensive annual hidden homeownership costs are Las Vegas ($9,886); Asheville, North Carolina ($11,318); and St. Louis ($11,824).

Home details that affect your homeownership costs

A few additional factors besides your real estate market can make your homeownership experience less or more expensive than the average, including:

- Age of the home

- Home’s condition based on inspection and disclosures

- Location (affects both contractor costs and climate-specific maintenance)

- Materials used for build and subsequent renovations or repairs

- Home warranty

Ongoing fixed costs of owning a house

Once you buy a home and move in, you’ll start paying a set of ongoing fixed costs for as long as you own the home.

Monthly mortgage payments (principal & interest)

If you put 10% down on a typical U.S. home, valued at about $350,000, and financed the rest with a 30-year, fixed-rate mortgage at 7%, here’s what the cost of borrowing would look like:

- Principal and interest: $2,096

- Private mortgage insurance: $155 (note that for many loans, you’ll only have to pay PMI until your equity in the home reaches 20%)

- Total monthly mortgage payment: $2,251

Property taxes

How much you’ll pay in property taxes depends on the tax rates where your home is located and how much your house is worth. Your property taxes are paid in a lump sum annually or biannually, either out of pocket or, more commonly, through your mortgage escrow account.

Nationally, homeowners pay an average of $2,827 in property taxes annually. Metro New Yorkers pay the highest property taxes out of the 40 studied, averaging $9,145 a year. Pittsburgh metro homeowners average the lowest property taxes at $1,055 annually.

Homeowners’ insurance

Homeowners’ insurance generally covers repairs or replacement of your home and its contents if they are damaged by certain hazards such as fires or other natural disasters and is almost always required by your lender.

The cost of homeowners’ insurance will vary depending on your location, the type of coverage you’re buying and any discounts you might qualify for, and your insurer.

Broadly speaking, homeowners pay about 0.5% of their home’s value every year for insurance. So for the typical home, valued at about $350,000, you’d pay about $146 a month. The cost is likely to be higher in areas prone to hazards, and lower in the most affordable metros, such as Pittsburgh ($994 annually) and Cleveland ($1,087 a year).

Coverage for rebuilding or repairs after an earthquake or flood is usually not included in standard homeowners’ policies, so you may want to — or in the case of flood insurance, have to — buy a separate policy.

If you’re buying with a mortgage, the lender will typically roll the cost of insurance into the monthly mortgage payment and pay the premiums on your behalf.

Homeowner association (HOA) fees

If your home is part of a homeowner’s association, you’ll be responsible for paying monthly, quarterly or yearly dues. HOAs are more common in condominium, townhome or planned communities.

Homeowner associations or HOAs are non-profit entities that can establish and enforce rules, provide basic services such as water and tend to the maintenance and repair of community amenities such as pools, roads and landscaping.

Commonly found in condominium, townhome and planned single-family home communities, HOAs are run by a board of homeowners and typically charge dues that you will be required to pay monthly or annually. Dues vary widely, and can change depending on the community needs. For instance, an association that has neglected maintenance or wants to undertake development of something such as a new park can raise dues or levy special assessments.

Maintenance expenses of owning a home

“Just like you would visit a mechanic for regular tune-ups to help keep your car in good condition and avoid big bills, your home needs the same routine maintenance to ensure that everything is running smoothly,” said David Steckel, Thumbtack’s home expert. “Staying on top of annual home maintenance will not only increase the value of your home, but will also help prevent emergency repairs that can wreck a homeowner’s budget.”

Maintenance costs are somewhat flexible because they may not impact every homeowner in the same way. For example, you could have to pay for lawn maintenance out of pocket or through your HOA or you may not have a yard to maintain. Although costs will vary, it’s helpful to get a feel for maintenance expenses.

Maintenance and upkeep

Based on data from millions of home projects completed across the country, home maintenance and upkeep runs about $6,413 annually, according to Thumbtack. The list of projects on which the list is based is a long one that may or may not apply to your circumstances:

- appliance maintenance

- carpet cleaning

- central air conditioning maintenance

- deck staining and sealing

- duct and vent cleaning

- fireplace and chimney cleaning

- full-service lawn care

- gutter cleaning and maintenance

- heating system maintenance

- house cleaning

- pressure washing

- roof maintenance

- sprinkler and irrigation system maintenance

- tile and grout cleaning

- tree trimming and removal

- water heater maintenance

- window cleaning

The average cost of upkeep is highest in Los Angeles and Chicago, totaling $8,639 and $7,722 respectively. Meanwhile, homeowners in Pittsburg pay an average of $3,373 and those in Cleveland pay $3,747 a year to maintain their homes.

Utilities

If you’re a first-time buyer, the cost of utilities could surprise you, especially if your previous rental home included utilities. Homeowners in Hartford, Connecticut, pay the highest utility bills, averaging $4,443 annually, according to the Zillow/Thumbtack research.

For homeowners in urban areas, utilities could include:

- water and sewer

- garbage pickup

- electric

- natural gas

- cable and internet

Rural utility costs could include:

- water

- septic repair and maintenance

- garbage pickup

- electric

- propane

- wood or wood pellets for heat

- internet

Larger homes are likely to cost more to heat and cool, and older homes may be less energy efficient unless they’ve had new windows installed and/or the insulation upgraded.

Home repairs and cosmetic updates

Depending on the age and condition of the home, you’re likely to run into things you want to update or have to fix.

Research and survey data from Zillow and home services website Thumbtack in 2021 shows that 65% of active shoppers are not looking for a fixer-upper. Yet the research found that the typical for-sale home could need nearly $30,000 worth of work, and that new homeowners should expect to spend $26,900 to make their new home move-in ready.

That’s substantially more than the $10,000 to $15,000 the average millennial surveyed by Thumbtack expects to pay for repairs and updates.

The most expensive project — evaluating, repairing or replacing heating and air conditioning systems — clocked in at a national average of $3,615.

New appliances

Everything in a home has a lifespan, and appliances are no exception.

If you’re buying a newly built home, the appliances should be new and under warranty. If you’re buying a resale home, the need to replace or repair an appliance can vary widely depending on the age and condition of the appliances.

At a minimum, most appliances will run you several hundreds of dollars for the most basic models. Add bells and whistles, and you could be looking at thousands of dollars to replace a refrigerator. You also could have to pay for installation, a pricey proposition if it involves changes to electrical wiring or plumbing.

How to prepare for hidden costs

A good place to start is to determine how much you intend to put down on the purchase, and then see how much you’re prepared to spend on closing costs and improvements.

A good rule of thumb is to have 1-4% of the home cost reserved for hidden costs.

Complete a home inspection

Look to your home inspection for a preview of what to expect. The best way to get a handle on possible costs for repairs and upgrades is to have a home inspected before you make an offer to buy it.

A good inspector can assess electrical systems and plumbing, structural soundness and the condition of the roof — and some inspectors can offer price estimates for various repairs. Even seemingly small repairs add up, so knowing what your house may need in advance can help set expectations for your wallet.

Once you have a handle on what repairs are needed, you can factor them into the cost of the house to determine the true cost of owning it, and compare the price to other homes that might not need as much work.

Set up an emergency fund

Home maintenance costs can be unpredictable. It’s smart to set aside 1-2% of your home’s value each year into an emergency fund, so that when those big-ticket repairs need fixing, you’ll already have the money set aside.

Make a plan for improvements

Plan for updates. Think about what things would have to be done immediately, what could wait, and — if you’re handy, what you might be able to do yourself. Be realistic. Some home projects, such as painting the outside or remodeling the kitchen, can take a long time when you’re working and/or tending to your family.

Forecast repairs and replacements

Although it’s impossible to pinpoint exactly when something in your home is going to fail or need replacing, you can use the expected lifespan to prepare, both financially and mentally, for upcoming projects. If you’re buying an existing home, your home inspector will usually estimate the age of the appliances at the time of your purchase. Here are common lifespans, according to the National Association of Homebuilders and Consumer Reports:

- Roof: 20-30 years, or 50+ years for slate or copper roofs

- Furnace: 18 years for a gas furnace, 15 years for electric

- Air conditioner: 15 years

- Oven/range: 15 years

- Refrigerator: 13 years

- Freezer: 11 years

- Washer/dryer: 10-13 years

- Dishwasher: 9 years

- Flooring: 10-100 years, depending on the material

Assess your appliances

Get to know your appliances. Ask your inspector to test the appliances during the home inspection, and ask your real estate agent to get the age of the appliances from the seller, along with typical cost of utilities in the summer and winter months.

Consider a home warranty

Research home warranties. A home warranty — which is a short-term service contract that helps home buyers cover the costs of repairing or replacing certain mechanical systems and applies during the first year of ownership, can take away some of the financial uncertainty. Depending on the level of coverage, home warranties typically cost between $300 and $800, and can usually be paid monthly or in a lump sum. You can ask the seller to pay for one or buy one yourself.

Ask about HOA maintenance practices

Since HOA dues are fixed for the year, they should be easy enough to figure into the budget. To get a sense of how stable those costs are likely to be long term, ask for a copy of the HOA’s most recent three annual financial reports to see whether it is spending money on routine maintenance. HOAs that kick the can down the road can end up with expensive projects that require special assessments or hefty dues hikes.

Add up costs for maintenance

If you’re contemplating a home with a yard, for example, do a cold-eyed assessment of how much time and money you need and want to spend maintaining it. If you prefer to hire someone to do it, put that in your budget.

Remember: Your list doesn’t have to be exhaustive, but it should get you close to what you’re prepared to spend. Having that monthly cost in mind, can help you determine whether the home you want to buy fits your budget.

Written by

Susan Kelleher

08.01.2023

A local agent can help you stay competitive on a budget.

They’ll help you get an edge without stretching your finances.

Talk with a local agent