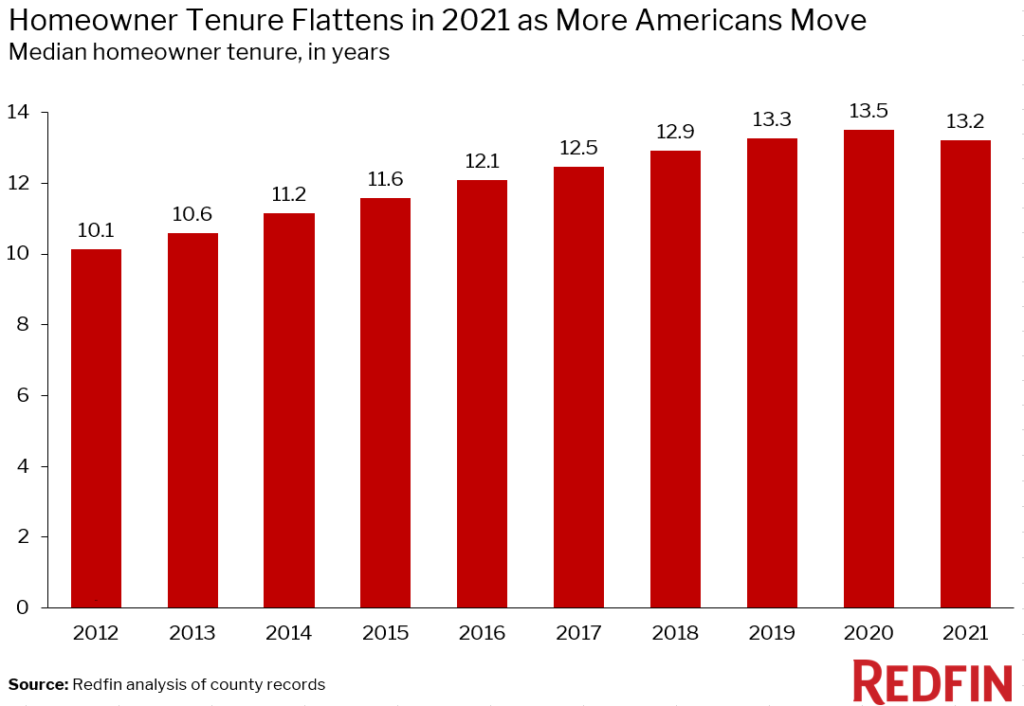

Homeowner tenure flattened near its peak in 2021 after steadily rising for nearly a decade

The typical American homeowner in 2021 had spent 13.2 years in their home. That’s down slightly from the peak of 13.5 years in 2020 but up significantly from 10.1 years in 2012.

The data in this report is from a Redfin analysis of median homeowner tenure by year in the U.S., using historical county records. Home tenure for 2021 is defined as the number of years between the most recent sale date of a home and Nov. 1, 2021.

Homeowner tenure flattened last year partly because so many Americans moved during the pandemic, with record-low mortgage rates encouraging homebuyers to dive into the market. Additionally, pandemic-fueled remote work led to a record share of Americans relocating, often to more affordable areas.

But overall, Americans are still living in their homes longer than before because of older homeowners aging in place, a shortage of homes for sale and relatively low monthly payments. Many Americans have refinanced their homes over the last decade to get a favorable mortgage rate. Some homeowners who refinanced would have locked in last year’s historically low rates, disincentivizing them from moving, which could lead to tenure increasing in the next few years. Rising rents could be another factor, as some homeowners may choose to rent out their homes rather than sell.

The supply shortage is one reason why homeowners stay put, and the reverse is also true. Long homeowner tenure is one factor in the ongoing housing-supply shortage and the ultra-competitive market, with the number of homes for sale down nearly 50% from before the pandemic.

“Homeowner tenure may have already peaked, or the decline in 2021 could be a blip before it climbs back up,” said Redfin Chief Economist Daryl Fairweather. “There are competing forces at work. Remote work is encouraging homeowners to sell their homes in expensive cities and move to more affordable areas, which could pull tenure down. But on the flip side, rising mortgage rates may discourage people from selling and older Americans are staying put longer, which could push it back up.”

“The migration trend is encouraging for supply because more people moving typically means more people selling their homes,” Fairweather continued. “Adding supply will help the housing market keep up with demand and start relieving buyers from heated competition and rapidly rising prices.”

Americans are aging in place, contributing to long homeownership tenure

Redfin data shows that older Americans are now making up a larger share of the population than they were a decade ago.

One-third (33%) of U.S. household heads were at least 65 years old in 2019, up from 28% in 2012. The share of Americans who are 65 and older is expected to increase substantially in the next few decades. The fact that Americans are aging, combined with older homeowners staying put, is a factor in rising homeowner tenure. Prior to the pandemic, older Americans were staying in their homes longer than previous generations, according to a 2019 report from Freddie Mac, accounting for an estimated 1.6 million homes held back from the real estate market at that time.

Additionally, as the coronavirus pandemic surged in nursing homes and senior-living communities, nursing-home occupancy rates fell from about 85% pre-pandemic to a low of 69% in February 2021. Fewer Americans opting to move into nursing homes–and instead presumably staying in their homes–may have contributed to homeowner tenure reaching a record high in 2020, though the decline in occupancy rates could also be partly due to coronavirus-related deaths. Nursing-home occupancy rates were back up to roughly 74% in January 2022.

Homeowners stay put longest in California

The typical Los Angeles homeowner had spent 18 years in their home as of 2021, the longest tenure of the metros in this analysis. It’s followed by Honolulu and Oxnard, CA, both with median tenures of 17 years. The typical amount of times homeowners held onto their homes in each of those metros increased by roughly four years in the last decade.

Homeowners tend to stay in their homes for a particularly long time in California–the median tenure is also longer than the national average in Anaheim, the Bay Area, Bakersfield, Fresno, Riverside and San Diego–because of the state’s unique property tax laws. California’s Proposition 13 incentivizes homeowners to hang onto their homes because it limits property-tax increases.

“Even if you’ve owned your home for 10, 20 or 30 years, you’re still paying close to your original property tax,” said Karen Ulloa, a Redfin agent in Southern California. “If you were to sell and buy a different home, you’d be paying much higher taxes. For some people, that means they literally can’t afford to move. Even if people move to a different area or a different house, they may hang onto their original home and rent it out because the low tax base makes those homes great investment properties.”

“One of the original reasons for Proposition 13 was to protect retirees from big tax increases,” Ulloa continued. “Now there are new laws on the books that allow people aged 55 and over to transfer their original property tax cost to a new primary residence, in hopes of encouraging older Californians to sell their homes. But I meet seniors all the time who don’t know how they can benefit from the updated rules, and I think more people here would sell their homes if they were aware of the newer laws.”

Homeowner tenure rose by about five years in three Midwestern metros—St. Louis, Detroit and Chicago—the biggest increases of all the metros in this analysis. The typical amount of time people own a home increased over the last decade in 59 of the 74 U.S. metros included in this analysis.

Supply shortages are a problem for homebuyers in most U.S. metros, and they’re exacerbated by increasing homeownership tenure. The number of homes for sale in both Los Angeles and Oxnard, for instance, fell by about 30% year over year in December, versus about 19% nationwide.

Homeowner tenure declined over the last decade in 15 metros, several of which are popular migration destinations. Median tenure declined by about one year in Atlanta, Las Vegas, Phoenix and Tampa, FL, all places that attract a lot of new residents.

| Metro-Level Summary, Homeowner Tenure | |||||

| Metro area | Median homeowner tenure (in years), 2021 | Median homeowner tenure (in years), 2012 | Change in median homeowner tenure (in years), 2012 to 2021 | Median sale price (Dec. 2021) | Median sale price, YoY (Dec. 2021) |

| Akron, OH | 15.5 | 11.7 | 3.9 | $179,900 | 15.0% |

| Allentown, PA | 14.7 | 11.0 | 3.7 | $275,000 | 14.6% |

| Anaheim, CA | 16.9 | 13.2 | 3.7 | $939,000 | 17.4% |

| Atlanta, GA | 9.8 | 10.3 | -0.6 | $350,000 | 22.8% |

| Bakersfield, CA | 14.3 | 10.3 | 4.0 | $340,000 | 19.7% |

| Baltimore, MD | 15.3 | 11.4 | 3.9 | $325,000 | 5.2% |

| Birmingham, AL | 11.6 | 9.6 | 2.0 | $265,000 | 12.3% |

| Bridgeport, CT | 13.6 | 9.9 | 3.7 | $490,000 | -1.6% |

| Buffalo, NY | 11.5 | 8.4 | 3.0 | $204,063 | 13.0% |

| Camden, NJ | 15.6 | 11.9 | 3.7 | $268,000 | 12.6% |

| Cape Coral, FL | 7.5 | 8.5 | -1.1 | $305,000 | 7.8% |

| Charleston, SC | 8.4 | 9.6 | -1.2 | $387,433 | 21.1% |

| Charlotte, NC | 8.6 | 9.7 | -1.1 | $357,000 | 20.6% |

| Chicago, IL | 15.4 | 10.7 | 4.7 | $287,000 | 7.9% |

| Cincinnati, OH | 14.1 | 10.9 | 3.2 | $236,000 | 9.3% |

| Cleveland, OH | 16.9 | 13.4 | 3.5 | $180,000 | 4.4% |

| Colorado Springs, CO | 8.5 | 10.5 | -2.0 | Not available | Not available |

| Columbia, SC | 13.2 | 10.4 | 2.7 | Not available | Not available |

| Columbus, OH | 13.1 | 11.2 | 1.9 | $274,900 | 12.2% |

| Dayton, OH | 16.9 | 13.1 | 3.8 | $175,000 | 10.1% |

| Denver, CO | 8.5 | 10.1 | -1.5 | $540,000 | 19.5% |

| Detroit, MI | 15.9 | 10.6 | 5.2 | $172,000 | 11.0% |

| Fort Lauderdale, FL | 13.9 | 10.5 | 3.4 | $363,000 | 16.7% |

| Frederick, MD | 15.5 | 11.6 | 3.9 | $495,000 | 11.5% |

| Fresno, CA | 15.6 | 11.6 | 4.0 | $380,000 | 18.8% |

| Grand Rapids, MI | 5.8 | 6.2 | -0.5 | $260,000 | 13.0% |

| Greensboro, NC | 14.9 | 12.0 | 2.9 | $230,000 | 12.5% |

| Hartford, CT | 13.4 | 9.3 | 4.0 | $271,750 | 6.6% |

| Jacksonville, FL | 12.9 | 10.9 | 2.0 | $320,000 | 18.7% |

| Knoxville, TN | 10.6 | 9.7 | 0.9 | $304,000 | 23.1% |

| Lake County, IL | 14.6 | 10.2 | 4.4 | $270,500 | 4.8% |

| Las Vegas, NV | 7.7 | 8.9 | -1.2 | $400,000 | 25.0% |

| Los Angeles, CA | 18.1 | 13.6 | 4.4 | $835,000 | 14.4% |

| Louisville, KY | 6.6 | 5.2 | 1.4 | $237,500 | 10.5% |

| Memphis, TN | 16.0 | 12.6 | 3.4 | $275,050 | 19.6% |

| Miami, FL | 15.8 | 11.7 | 4.1 | $434,900 | 20.8% |

| Milwaukee, WI | 11.6 | 9.3 | 2.3 | $247,250 | 8.0% |

| Minneapolis, MN | 11.0 | 10.1 | 1.0 | $335,000 | 8.1% |

| Montgomery County, PA | 15.3 | 12.3 | 3.0 | $383,750 | 9.6% |

| Nashville, TN | 8.3 | 8.6 | -0.3 | $410,000 | 24.2% |

| Nassau County, NY | 16.1 | 12.5 | 3.6 | $575,000 | 7.5% |

| New Brunswick, NJ | 14.6 | 11.6 | 3.0 | $425,000 | 10.4% |

| New Orleans, LA | 14.8 | 10.6 | 4.2 | $274,000 | 9.6% |

| New York, NY | 15.2 | 11.4 | 3.8 | $645,000 | 9.3% |

| Newark, NJ | 15.4 | 11.5 | 3.9 | $460,000 | 8.2% |

| North Port, FL | 8.6 | 10.1 | -1.5 | $417,777 | 28.6% |

| Oakland, CA | 16.2 | 12.3 | 3.9 | $876,000 | 8.1% |

| Oklahoma City, OK | 11.9 | 9.3 | 2.6 | $225,000 | 9.8% |

| Orlando, FL | 9.3 | 9.6 | -0.3 | $358,000 | 23.4% |

| Oxnard, CA | 17.0 | 13.0 | 3.9 | $805,000 | 18.2% |

| Philadelphia, PA | 15.6 | 11.6 | 4.0 | $255,000 | 6.3% |

| Phoenix, AZ | 8.3 | 9.1 | -0.8 | $435,000 | 27.9% |

| Pittsburgh, PA | 15.3 | 12.5 | 2.8 | $201,500 | 4.8% |

| Portland, OR | 11.7 | 9.8 | 1.9 | $510,000 | 13.3% |

| Raleigh, NC | 8.4 | 9.2 | -0.8 | $395,000 | 25.4% |

| Richmond, VA | 15.0 | 11.6 | 3.4 | $309,000 | 4.8% |

| Riverside, CA | 13.9 | 10.4 | 3.5 | $530,000 | 20.5% |

| Rochester, NY | 11.0 | 8.8 | 2.1 | $178,600 | 5.1% |

| Sacramento, CA | 13.0 | 10.9 | 2.1 | $546,000 | 14.9% |

| San Diego, CA | 15.4 | 12.1 | 3.3 | $770,000 | 16.7% |

| San Francisco, CA | 15.4 | 11.0 | 4.4 | $1,489,500 | 10.3% |

| San Jose, CA | 16.7 | 13.0 | 3.7 | $1,365,250 | 14.7% |

| Seattle, WA | 12.2 | 10.0 | 2.2 | $729,915 | 17.7% |

| St. Louis, MO | 15.1 | 9.7 | 5.3 | $221,000 | 7.3% |

| Tacoma, WA | 14.2 | 9.7 | 4.5 | $515,000 | 19.8% |

| Tampa, FL | 9.6 | 10.2 | -0.7 | $339,000 | 24.8% |

| Tucson, AZ | 13.6 | 10.6 | 3.0 | $329,000 | 25.3% |

| Tulsa, OK | 12.0 | 9.0 | 3.0 | $220,000 | 4.8% |

| Urban Honolulu, HI | 17.4 | 12.9 | 4.5 | $715,500 | 10.1% |

| Virginia Beach, VA | 13.7 | 10.5 | 3.3 | $285,000 | 6.1% |

| Warren, MI | 12.5 | 11.6 | 0.9 | $255,000 | 6.3% |

| Washington, DC | 14.2 | 10.4 | 3.8 | $489,000 | 8.7% |

| West Palm Beach, FL | 9.7 | 10.5 | -0.8 | $385,000 | 13.2% |

| Wilmington, DE | 16.2 | 12.3 | 3.9 | $285,000 | 8.7% |

United States

United States Canada

Canada