Stations, Networks Eye Boom in Political Ad Spending

Huge amounts raised by campaigns take outlays into uncharted territory

At Gray Television, the VP for political sales cannot handle any interviews. He is “already so overworked” by the ongoing deluge of campaign commercials on the broadcaster’s 93 stations as political campaigns unleash last-minute commercial tactics, said Kevin Latek, Gray’s executive VP and chief legal & development officer.

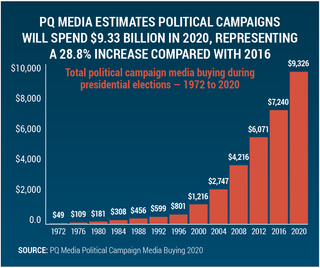

Similar ad assaults are underway throughout the media landscape as another wave of the $9.7 billion political juggernaut continues, according to PQ Media’s tally of national, state and local campaign spending. Industry observers said the money — predominantly for Democratic candidates and causes — is “unprecedented.” Everything about the process, from immense early voting to the amount of campaign funds, has forced broadcasters and political strategists to overhaul their approaches and manage ad inventory.

The impact of early voting continues to keep political strategists hopping. By the day of the final presidential debate on Oct. 22, more than 40 million voters had cast their ballots, per CNN. Accompanying the start of early October voting was an unusual peak in TV advertising. For example, in Florida, about $9 million was spent per week for former Vice President Joe Biden, the Democratic candidate, and $6 million for President Donald Trump, the incumbent Republican. Operatives are also scheduling typical Halloween weekend ad binges just ahead of Election Day on Nov. 3.

So much money is in the Democrats’ war chest that strategists are trickling it tactically to state legislative campaigns, generating countless party-funded commercials for local candidates. The goal is to flip key state legislatures in anticipation of post-U.S. Census redistricting efforts.

Presidential and Senate campaigns are adopting an Obama-era practice of buying time on national networks such as RFD-TV and WGN America, where viewership is concentrated in swing states. Commercial time on national networks is lower than buying broadcast station ads in expensive markets. Among the major beneficiaries are sports networks, which have gotten national buys during games featuring teams from North Carolina, Wisconsin and Ohio, aimed at home-state viewers.

RELATED: Cover Story: The Longest Night

Advertising Analytics, a research firm that tracks weekly spending, showed the Biden campaign significantly upped spending in key states such as Pennsylvania, Florida and North Carolina in the first weeks of October, just as early voting began. Campaigns are shifting their funds to swing states, including Arizona and Pennsylvania, as they sense shifting sentiments they can exploit with targeted ads.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The result: Busy — and lucrative — schedules at TV stations in key markets.

Reaping the Bonanza

In preliminary guidance for its third-quarter 2020 financial report (scheduled for a Nov. 5 release), Gray TV said it expects political advertising revenue to be between $120 million and $125 million during the July-to-September period. That dwarfs the Q3 political ad revenue of the combined Gray and Raycom Media stations in previous campaign cycles (reflecting the January 2019 merger of the companies and divestiture of some stations).

This year’s Senate races include seven of the 10 most-expensive campaigns ever, according to Advertising Analytics. Politico’s tally shows that the 14 most competitive and expensive races had campaign funds of $363 million for Democrats and $143 million for Republicans during the quarter ended Sept. 30.

Democratic candidate Jaime Harrison “has raised more money than has ever been seen in South Carolina” in his race against incumbent Lindsey Graham, said Leo Kivijarv, executive VP and research director at PQ Media, a Connecticut research firm. He also cited the $100 million that former Democratic presidential candidate Michael Bloomberg has earmarked for Florida campaigns aimed at Hispanic get-out-the-vote initiatives, targeted to likely Biden supporters.

Kivijarv said that TV stations are also benefiting from campaign ads aimed at Hispanics in states with sizable ethnic populations, including swing states North Carolina, Wisconsin and Michigan. PD Media’s data jibes with a recent Kantar Media Campaign Media Analysis Group (Kantar/CMAG) study that found a boom in Hispanic-targeted ads since September: $932 million spent on presidential commercials on TV and radio, nearly two-thirds of it backing Biden. Telemundo and Univision stations are benefiting from this spending, Kivijarv said. He also expects a splurge the week before Election Day, aimed at the dwindling number of “undecideds.”

RELATED: The New Math of Election Coverage

Digital advertising has been a major success story this year, said Mark Jablonowski, managing partner and chief technology officer of DSPolitical, a Democratic-focused agency. He cited Democrats’ $14 million of spending on Facebook.

“Voter-targeted digital makes the task of communicating with the right voters easier than ever,” Jablonowski said. He thinks well-funded Democratic Senate campaigns could “max out their spending everywhere, including digital,” especially in states where there wasn’t “television left to buy but there is a lot of digital inventory.”

Reaching for Everyone

The available money has made this year’s campaign “a time for tanks, not rifles,” Republican ad consultant Evan Tracey said.“Targeting is out the window. You’re reaching for everyone.” He acknowledged that shifting sentiments have encouraged campaigns to shore up spots in contested markets, which is why money for GOP ads in Ohio was diverted to Michigan and Pennsylvania.

“Everything this year is bigger,” Steven Passwaiter, VP and general manager of Kantar/CMAG, said. He said broadcasters are “relishing the salve” of this year’s political spending after 2016, when the Trump campaign curtailed its ad spending. Kantar’s political spending estimate has climbed to $7 billion from $6 billion — still shy of PQ Media’s number.

RELATED: Streaming to the White House

“Money is being spent differently,” Passwaiter said. He cited Biden ads on Smithsonian Channel as both an offbeat choice and an acknowledgment that cash is available to spend on niche networks. Although he’s not surprised by the spread of money throughout October, which typically gets 40% of the cycle’s ad spending, Passwaiter said there is so much money, media spending in some smaller states is “rivaling that of the top five markets.”

Passwaiter said the spending could continue after Nov. 3, especially if there is an almost-inevitable runoff for the Senate seats from Georgia. That campaign could run through January, he said.

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.