The 12 hottest housing markets in 2021 revealed

These conditions created

As 2021 shapes up to be a robust year for mortgage volumes, local lenders discuss the 12 metro areas that are expected to get the most interest from buyers, according to Zillow.

Read the full story

FHFA allows borrowers to prolong forbearance plans

As of Feb. 28, borrowers who are in forbearance plans will be permitted to request an additional three-month extension, covering up to 15 months of mortgage payments overall for borrowers with Fannie and Freddie-supported loans, the FHFA said.

Read fully story

Prolonged plateau in mortgage rates adds to signs of market shift

At 2.73% the 30-year Freddie Mac rate reprised its number from

Because the CPI number only inched up slightly, it improved the odds that government officials will keep putting downward pressure on rates rather than tapering it. Stimulus has included federal purchases of bonds tied to long-term rates.

Read full story

LoanDepot shares soar after slashing the IPO’s price and size

The offering ultimately consisted of 3.85 million shares at $14 per share; with an underwriters' option to purchase an additional 577,500 shares.

The stock quickly shot up with a high of $17.77 per share when it started trading on Thursday morning; by 1:30 p.m. it backed down to $17.05. But in the last half hour of trading the price leaped to a high for the day of $23.49 before closing at $22.09.

Read full story

Nonbank stock performance has New Residential squeamish about its NewRez IPO

"We think that it will create more value for shareholders by separating the company and bringing it into the public markets," said Michael Nierenberg, its chairman, CEO and president, on its fourth quarter conference call. "But as you've seen from some of the recent attempts…some of them have gone OK; others have not gone as well."

A confidential registration statement was filed in November. If there was to be a public offering, the two companies would still be intertwined as New Residential would likely maintain a substantial stake in a publicly-traded NewRez, he said.

Read the full story

Freddie Mac's 2020 earnings rose as it delivered 'record liquidity'

The government-sponsored enterprise reported fourth quarter net income of $2.9 billion, compared with $2.5 billion

For the full year of 2020, Freddie Mac earned $7.3 billion, slightly higher than the $7.2 billion

Read the full story

Fannie Mae’s 2020 earnings fall due to COVID-related credit expenses

The government-sponsored enterprise reported a fourth quarter net income of $4.6 billion, up from $4.2 billion

The annual decline was primarily due to nearly $900 million of credit-related expenses incurred as a result of the pandemic, which compared with $3.5 billion of credit-related income in 2019, Fannie’s chief financial officer Celeste Mellet Brown said on the earnings call.

Read the full story

Prolonged plateau in mortgage rates adds to signs of market shift

At 2.73% the 30-year Freddie Mac rate reprised its number from

Because the CPI number only inched up slightly, it improved the odds that government officials will keep putting downward pressure on rates rather than tapering it. Stimulus has included federal purchases of bonds tied to long-term rates.

Read the full story

Acting CFPB head calls out industry for slow complaint response times

In a

Read full story

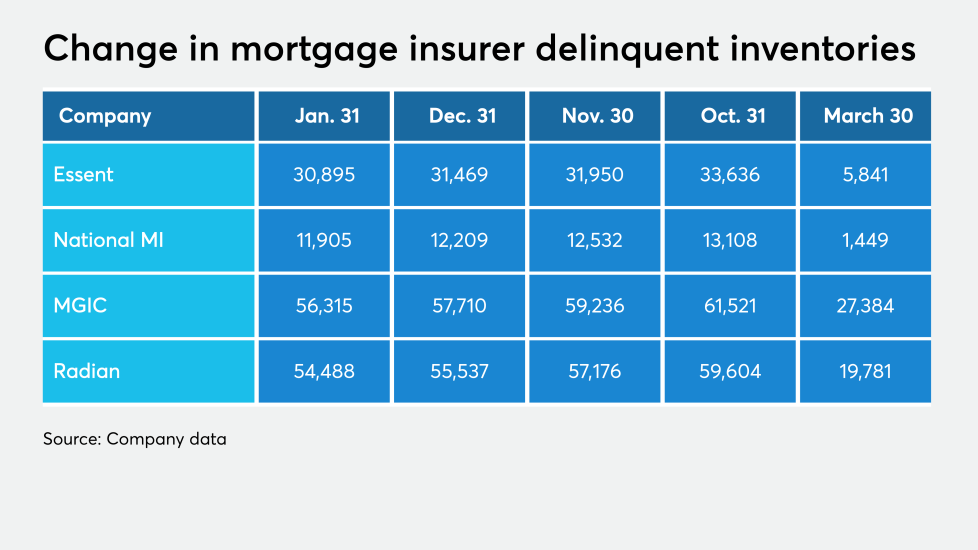

Mortgage insurers log fewer delinquencies but pace slows at legacies

That is likely reflective of the pattern of government-sponsored enterprise mortgages in forbearance, which continued to drop, but also at a slower rate, according to Black Knight. Between the weeks of Jan. 5 and Feb. 2 the number declined by 19,000 units, bringing the total to 913,000 loans. But between Dec. 8 and Jan. 5, GSE mortgages in forbearance fell by 33,000.

Read the full story

More than 1 million homeowners feared imminent foreclosure in December

As the end of 2020 approached, approximately 1.2 million borrowers were afraid they would be foreclosed on within 30 days, according to new data in a Research Institute for Housing America report backed by the Mortgage Bankers Association.

Read the full story

Mortgage applications down as rising rates suppress activity

The MBA's Market Composite Index was down 4.1% on a seasonally adjusted basis and 3% unadjusted for the week ended Feb. 5 compared with

"Treasury rates have been driven higher by expectations of faster economic growth as the COVID-19 vaccine rollout continues," Joel Kan, the MBA's associate vice president of economic and industry forecasting.

Read the full story

Kelly Purcell, digital mortgage pioneer, dies at 58

Purcell was a pioneer of electronic signature technology, co-founding SignOnline in 1999, a year before the federal legalization of e-signatures. Since October 2018, Purcell served as NotaryCam’s EVP of marketing and business development.

SignOnline — later renamed eSignSystems — still lives on. It was acquired by Wave Systems in 2001 and again

Read the full story

Commercial mortgage lending expected to see slight recovery in 2021

The trade group forecasts $486 billion in loans secured by income producing properties will be originated this year, compared with an estimated $440 billion in 2020, a year in which commercial real estate was heavily impacted by COVID-19, especially

"The economic rebound MBA anticipates in the second half of the year should bring greater stability to the markets, but with continued differentiation by property type," Jamie Woodwell, vice president for commercial real estate research, said in a press release. "Much of the path forward will depend on the virus and our confidence and ability to move past it."

Read the full story

Lenders discuss how they plan to shorten loan timelines ahead of spring

Purchase loans that take longer than 90 days do measurably hurt customer referrals, according to Garth Graham, senior partner at the Stratmor Group. When these rose to 7% in the fourth quarter of 2020 from 5% 2Q20, net promoter scores dropped from 73 to 67, Stratmor found.

That’s why lenders are investigating where an otherwise speedy pre-closing loan process is getting jammed up. They discuss their strategies for shortening timelines with NMN.

Read the full story