JPMorgan Chase resolves appraisal bias charges with HUD

The settlement calls for the bank to pay $50,000 to an unnamed Chicago woman and require its staff to undergo training in fair lending practices as they relate to appraisals.

Read the full story

New loan type unveiled: retirement mortgages

This new product — named EquityAvail — funds at closing and the borrower has to make payments for 10 years but at a reduced amount from their current loan. And like on a forward mortgage, an escrow for taxes and insurance is established.

Read the full story

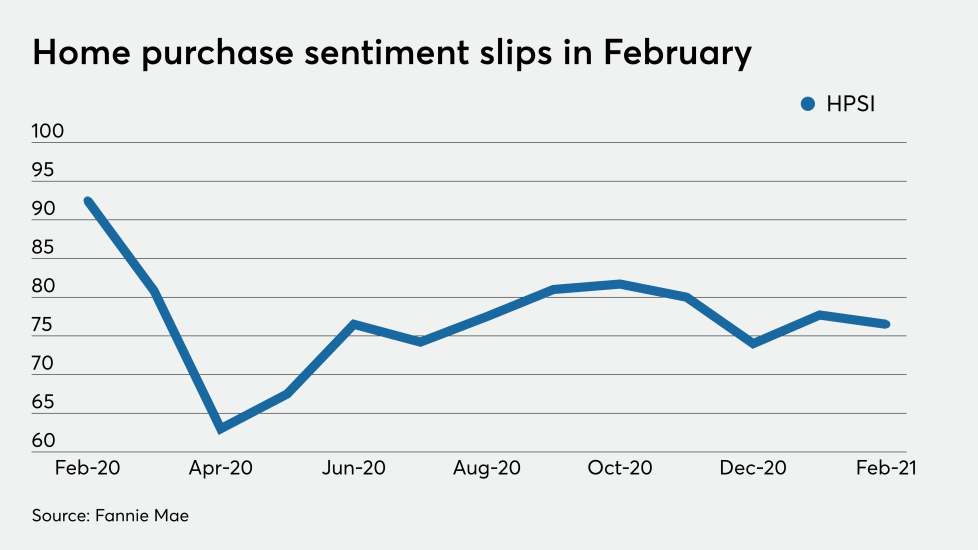

Home purchase sentiment slips despite positive economic outlook

Its Home Purchase Sentiment Index declined for the third time in the last fourth months, falling to 76.5 from 77.7

Read the full story

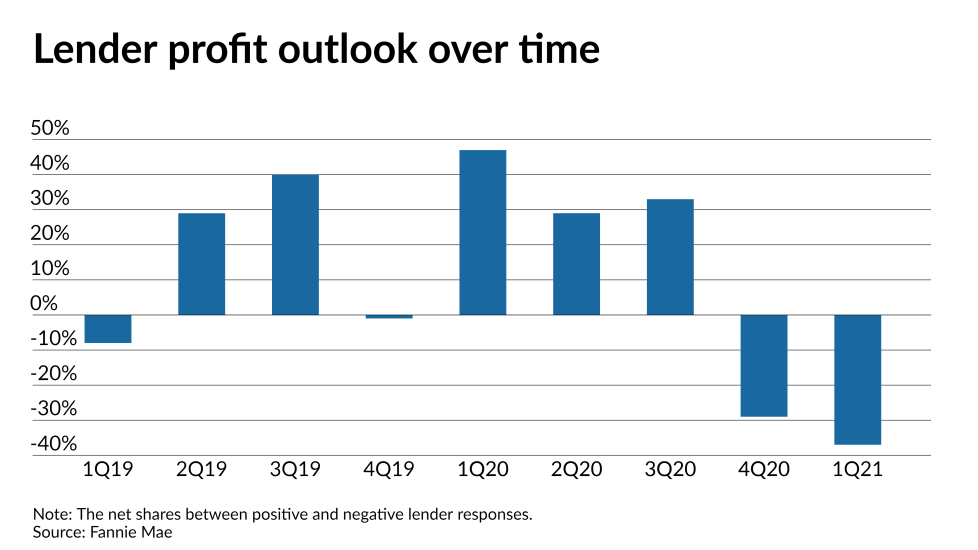

Record share of lenders expect shrinking profits in 2021

In the first quarter, 52% of industry executives predicted their upcoming margins will shrink, compared to

Read the full story

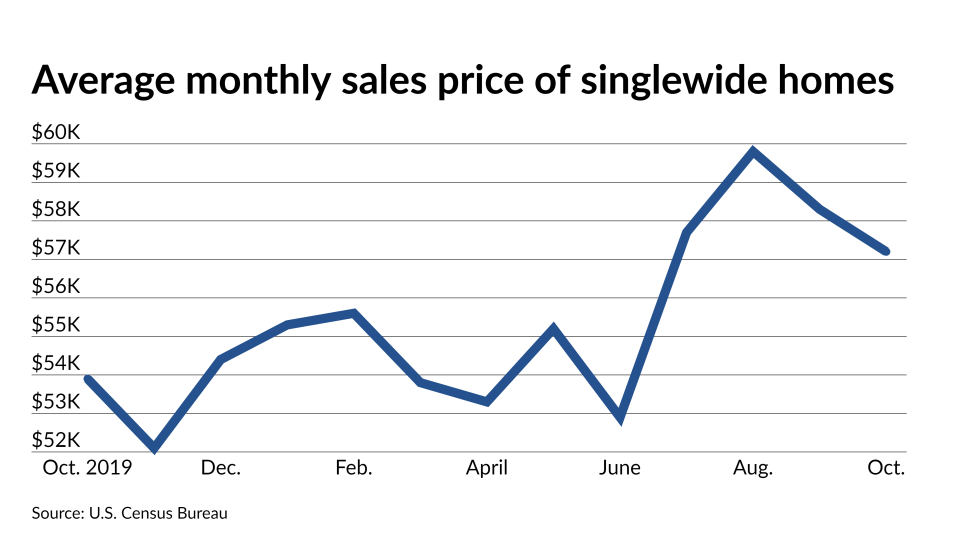

AFR adds new loans for singlewides as manufactured home options grow

AFR is offering

Read the full story

Mortgage credit offerings shift entering spring buying season

The Mortgage Bankers Association's Mortgage Credit Availability Index for February was

Read the full story

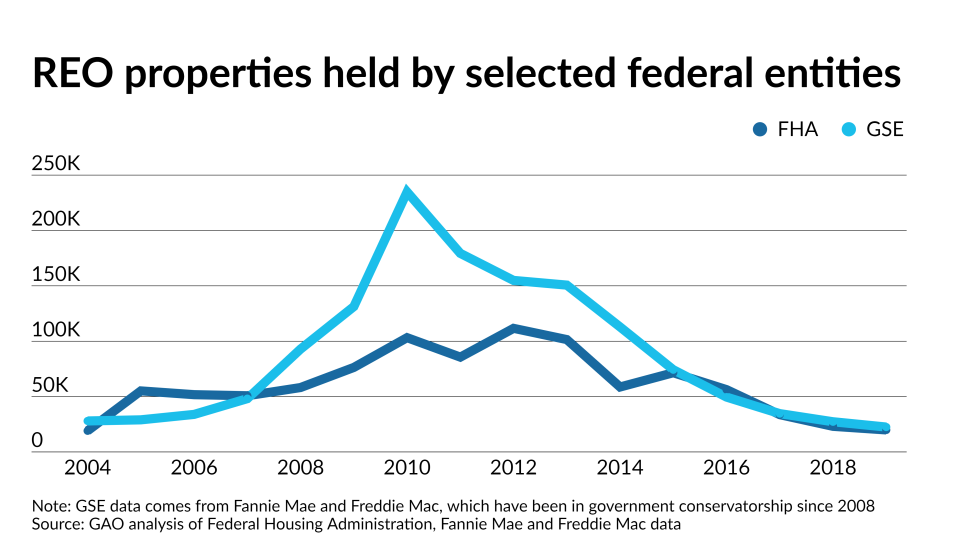

REO firms look out for new ‘mission’ metrics after GAO recommendation

Already one agency, the Department of Veterans Affairs, has committed to the recommendations of the report published last Friday. The report calls for the collection of new data that reflects if sales outcomes are in line with an agency's particular mission. In the VA’s case that means measuring veteran purchases of REO properties in its regular monthly performance reports.

Read the full story

Millennials entering home market are the oldest ever

The average age for millennial borrowers swelled to 33 years from 31.3 in January 2020 and 31.9 in December. The next highest average age came in April 2020 at 32.3 years.

Read the full story

Rising rates drive down refi apps but no impact on purchases

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.3% from

Read the full story

Home Point reports rise in loan broker inquiries as competitors battle

When asked what Home Point was hearing from mortgage brokers following

The war of words seems to be accelerating Homepoint's growth in the wholesale channel.

Read the full story

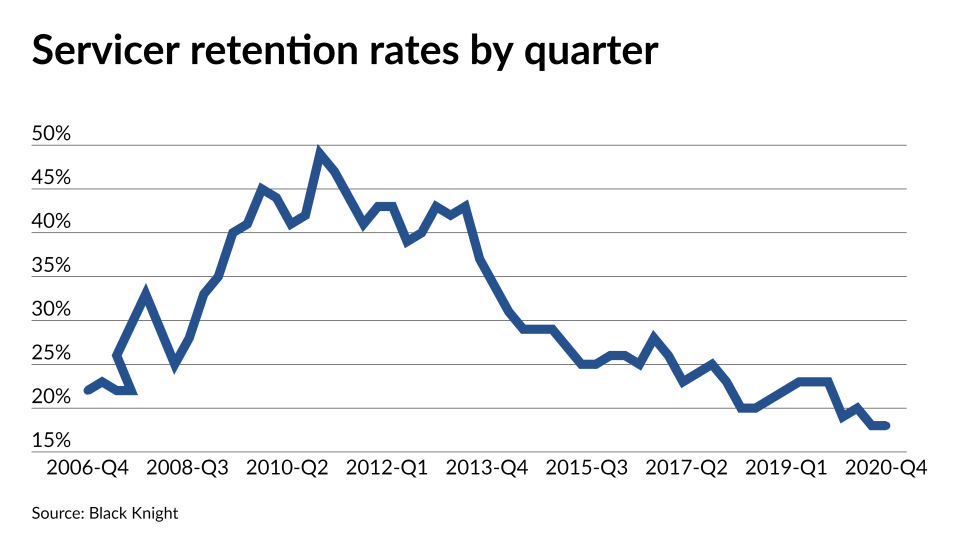

Retention rates fade to record lows for mortgage servicers

The retention rate fell to 18% compared to

Read the full story

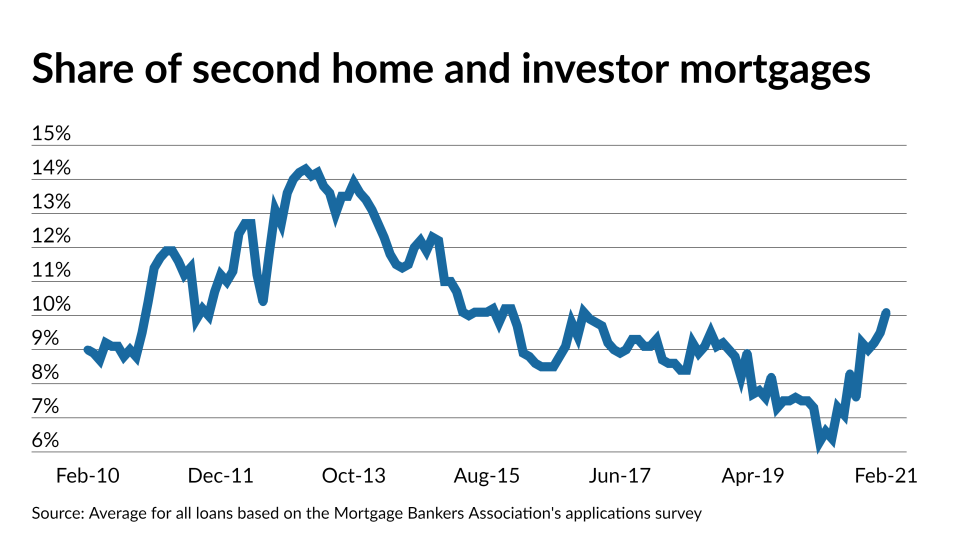

Fannie Mae’s early start on limiting certain loans surprises lenders

Fannie Mae announced April 1

This worries mortgage companies because alternate investors’ prices might not be as favorable as Fannie’s.

Read the full story

It's the seventh-inning stretch in mortgage-land

This is not to say that 2021 will not be another extremely good year for the mortgage industry, but the wind that promoted record loan originations is clearly shifting.

Read the full story

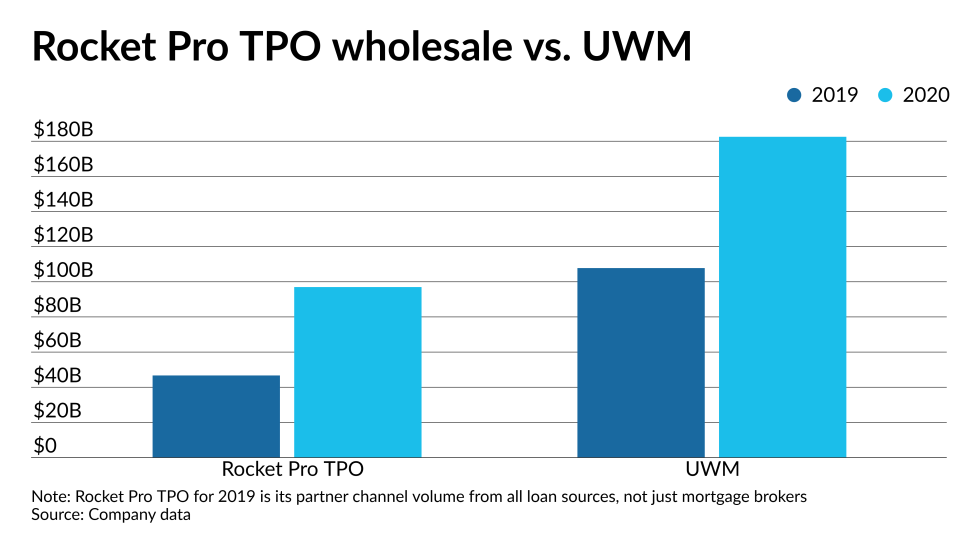

UWM boycott motivated by market share loss, Rocket exec claims

That's what really motivated

Read the full story