Re-Envisioning ESG in 401(k) Retirement Plans

Proxy voting provides a way for investors to have a say on ESG issues.

The drive behind environmental, social, and governance investing has only quickened its pace in the past year, but some investors likely feel as if they are falling behind.

Given that most individual investors only invest via their retirement plans, many of their ESG investing options are limited. In our recent research, we take a closer look at investors' options to incorporate ESG into their retirement investing decisions. We then take a deep dive into an often overlooked, yet potentially powerful, way in which investors can have a voice in ESG issues: proxy voting. Morningstar Direct and Office clients can find our full report on ESG investing in 401(k) plans here.

What is ESG investing?

Environmental, social, and governance investing makes sense to many investors both as a strategy of risk mitigation and for value alignment, especially for investors with long-term retirement goals.

Environmental factors include sustainable use of natural resources, energy efficiency, and pollution abatement. Social factors prioritize the fair treatment of stakeholders beyond shareholders, including employees and community members of diverse backgrounds. Finally, governance factors focus on transparent and ethical business practices, and on balancing competing claims among stakeholders.

Since retirement savers plan for growth over multiple decades, many may look to portfolios incorporating ESG factors as a way to reduce risk as the world experiences major changes in its climate, diversifying workforces, and increased scrutiny of business practices. Many investors also desire to make positive change and are increasingly aware of the influence of their financial assets in promoting such change.

How can investors pursue ESG investing in their 401(k)s?

In previous research, we found that ESG-focused investors may be at a loss when trying to find sustainable funds--funds that pursue a sustainability-related mandate or explicitly aim to create measurable social impact--in their plan lineups.

Although the number of ESG funds available in the industry tripled between 2014 and 2020, we find that still less than 5% of defined-contribution plans include at least one sustainable fund. The U.S. Department of Labor has in the recent past taken a decidedly skeptical view of how fiduciaries should consider ESG factors under the law governing employer-sponsored pension plans. It is perhaps not surprising, therefore, that ESG-dedicated funds only make up a fraction of a percentage of total assets in 401(k) plans.

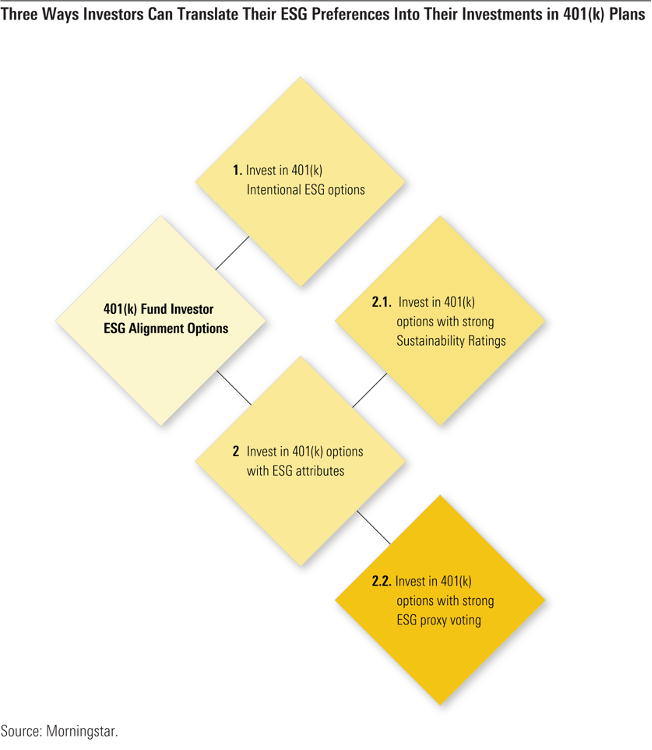

Exhibit 1 below illustrates three key pathways in which workers can account for their ESG preferences as they invest in their 401(k) plans. Since pathway 1--directly investing in intentional ESG funds--is not available for many workers, a potential solution is to incorporate other ESG-oriented filters to fund selection. There are two broad and potentially complementary pathways to this approach:

2.1 Incorporate fund ESG metrics when making investing decisions.

2.2 Consider how a fund votes on ESG-related shareholder resolutions.

Exhibit 1

Looking to Fund-Level ESG Metrics

Interested investors can take heart in the fact that many non-dedicated ESG funds may nevertheless look quite good on holdings-derived sustainability attributes, such as the Morningstar Sustainability Rating for funds and Low Carbon Designations. Our research found 71% of DC plans have at least one fund with a high Morningstar Sustainability Rating. Therefore, investors can compare the sustainability ratings of available fund options and find a plausible way to account for ESG factors in their retirement-savings plans.

Looking to ESG Proxy Voting

Investors can also look to how a fund votes on ESG-related shareholder resolutions while making investing decisions.

Although it's a more obscure part of the investment process, it appears that proxy voting is attracting more investor interest. As evidence, a majority of investors who responded to an online survey indicated that they would consider how a fund votes on ESG resolutions as a factor in fund choice. Previous Morningstar research finds that even dedicated ESG funds do not support sustainability measures at company shareholder meetings as often as one might expect.

In our research, which is based on 2020 voting records, we find that many of the funds with the most 401(k) assets voted predominantly against important ESG resolutions. This limits the degree to which plan participants can choose funds that align with their voting preferences.

However, not all hope is lost, because there are still a few funds that tend to support ESG resolutions, such as the Fidelity funds managed by Geode Capital Management.

How Investors Can Begin Having a Say

There are a few efforts in the investing realm that are focused on helping investors take advantage of the immense power they collectively have when it comes to proxy voting.

For example, the SEC has expressed interest in strengthening mutual fund proxy voting transparency to give retail investors more insight into how the funds that they’re invested in vote on their behalf and, ultimately, to make funds more accountable to end investors.

There are also several startup initiatives, like U.K.-based Tumelo, that offer platforms and proxy services that aim to close the gap between the end investor and the voice that their investments carry through proxy voting and engagement. In our research, we find a growing interest in these types of tools.

Lastly, there are recent calls on investors to vote with their feet, by exerting their influence through reallocating their funds or demanding that employers offer different retirement options. These new proposals in the world of proxy voting can help redistribute voting power to individual investors.

For now, however, individual investors who are focused on ESG can start by taking a look at whether the fund companies they own are voting in line with their preferences.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ff370d56-5946-45e8-a1ea-5e50301bc997.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ff370d56-5946-45e8-a1ea-5e50301bc997.jpg)