Over these last months of quarantine, we at Madrona have remained very busy, first and foremost working with our portfolio companies to help them navigate the economic turmoil of a global pandemic. Second, but also importantly, we have continued to invest, adding eight new companies to our portfolio since quarantine began in March (Fauna, VNDLY, Go1, Zeitworks and four others still unannounced). This continued active pace of investment exemplifies both our commitment to the long-term opportunities we have identified, as well our belief that downturns can be the best time to invest.

As we have been quarantined in home offices in front of Zoom and Teams, we have also taken the opportunity to step back and revisit our investment themes and think about which trends we continue to be most excited, which are emerging, and which perhaps are being accelerated (or dampened) by the aftermath and “new normal” of COVID-19.

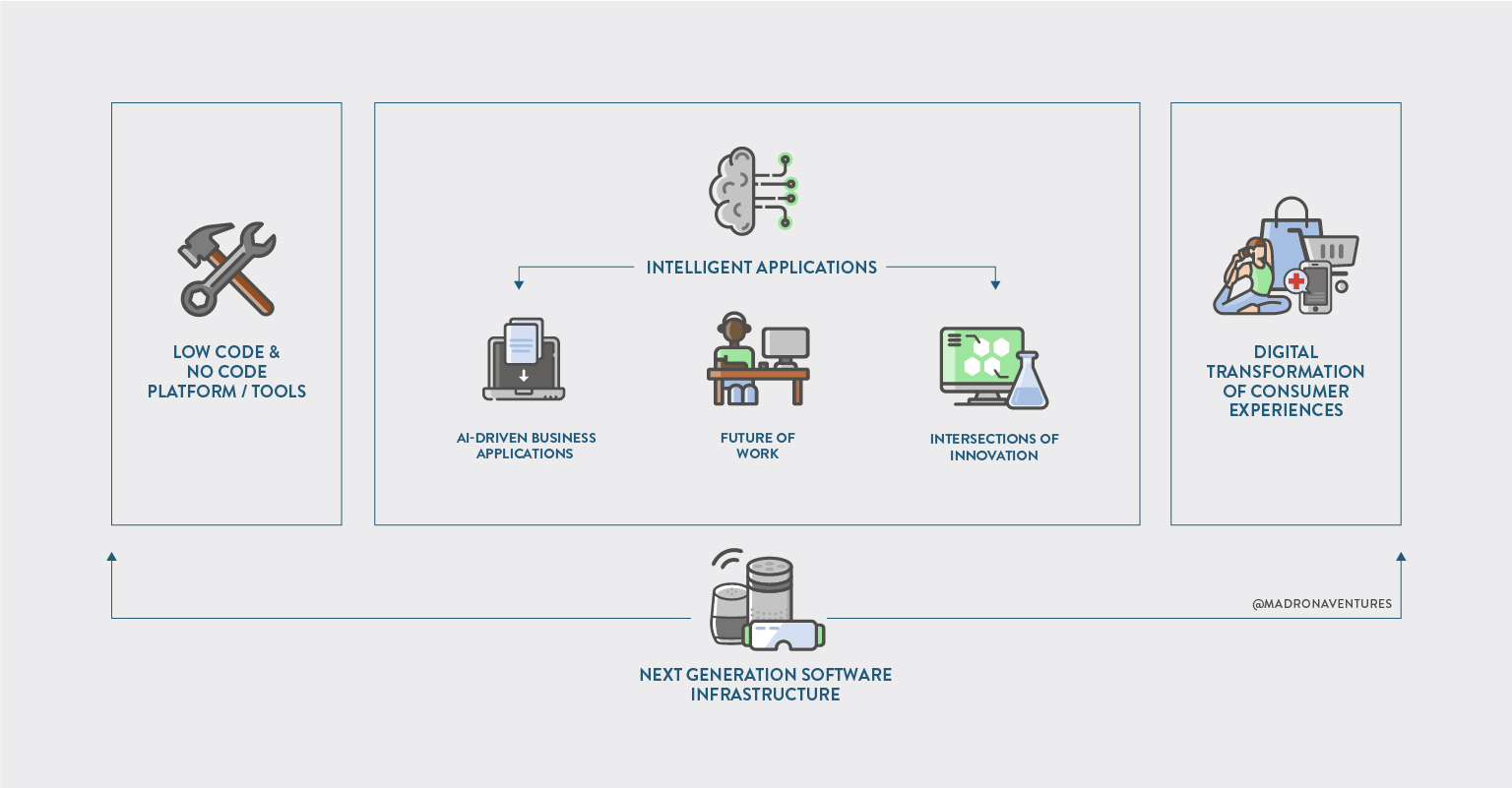

It has been 18 months since we last posted about the investment themes that are driving our activities at Madrona. When we took a fresh look at our current thinking on technology trends that we believe will drive the industry in the next five, ten, or 20 years, the picture that emerged shows significant consistency with our view of the world 18 months ago, but also interesting new opportunities and trends. The figure above illustrates the overall areas we find most compelling for new company and investment opportunities.

In this post we offer a preview of the themes and will follow this up with deeper dives on the areas outlined in the image above. We work as a team to fully investigate and build our investment themes and you will see many from the Madrona team as authors – please reach out to us with ideas and your thoughts!

At the center of our investment themes, we continue to see a massive opportunity for companies to create businesses around intelligent applications, fueled by machine learning and modern user interfaces. We believe that every successful application being built today should be an intelligent application, with a data strategy and continuous learning system at its core. Intelligent applications have been the single largest area of investment for us over the previous several years, and we expect this to continue for the foreseeable future. We will continue to invest in the next generation of line-of-business applications being reinvented by machine learning and cloud native delivery. Read more about the areas we are seeing opportunity in intelligent applications in our deep dive.

As the world continues to struggle through the COVID pandemic, we also see a massive acceleration in the emergence of technologies enabling the future of work. This trend had been evolving for the last several years and the current environment has created an order of magnitude acceleration, as businesses of all sizes rush to find new intelligent applications that help them collaborate more effectively when all employees are remote, build and retain more diverse and distributed workforces, and prioritize digital-first workflows and processes that have remained largely “in-person” and workplace focused. Read more about the work, the workplace, and workforce in our deep dive.

A major new focus area for Madrona is the intersection of innovation between machine learning, intelligent applications, and life science. We touched on this opportunity in our investment themes 18 months ago, and subsequently invested in several exciting companies including Twinstrand, Nautilus Biotechnology, and Terray Therapeutics. As our partner Matt wrote when we announced our recent large investment in Nautilus: “Today, these domains are coming together to transform the ways we understand and improve life and health. The biological and chemical sciences are intersecting with computer and data sciences in precision medicine, digital pathology, proteomics and more. At Madrona, we believe these intersections of innovation will be at the forefront of major breakthroughs in research, analysis, diagnostics, clinical processes, preventions and cures.”

Next, the march to the cloud and broader adoption of the cloud computing model by enterprises continue to create myriad opportunities for next-generation software infrastructure companies — despite the increasing dominance of the hyperscale public cloud providers. These steady improvements to software infrastructure enable and increase the pace of innovation for all the applications higher in the stack that leverage these cloud services. Enterprise need for better usability, manageability, security, cost-savings, and performance across diverse devices, cloud platforms and environments will drive new business opportunities that provide hybrid and multi-cloud management, infrastructure automation, and new architectures that leverage serverless and event-driven architectures. Read more in our deep dive on The Remaking of Enterprise Infrastructure.

Another investment theme created by the need to move faster, increase productivity and reduce cost is in the area of low-code or no-code platforms and applications. The next generation of workers is more tech savvy, and there are more “makers” in business teams and organizations who want to build things directly and not wait for IT, engineering or the data science team. These range from developers who need to incorporate ML directly into the applications they are building to information workers who become citizen developers in order to quickly solve business problems. Read more about how we think about no-code/low-code in our deep dive.

While we have invested a somewhat higher percentage of our last several Funds in B2B companies, we continue to strongly believe in and invest in new consumer services, often where the digital and physical worlds are fused in a way that create a virtuous cycle to provide a more compelling and fully integrated experience. This digital transformation of consumer experiences, where mobile-first applications streamline, simplify, and save consumers time and money, is a core pillar in our investment themes going forward. Read our deep dive on the areas we see changing dramatically in the next five years here.

We are eager to engage with all of you in the community around these updated investment themes. Each time we have published our thoughts in the past, we have been energized and humbled with the feedback we have received – from founders whose vision hew closely to one of our themes to constructive debate on how we are too early or too late with our ideas. In the coming weeks, we will post six deeper dives into our themes around software infrastructure, intelligent applications, the future of work, the intersections of innovation, low-code/no-code platforms, and the digital transformation of consumer experiences. We can’t wait to further discuss, debate and learn from all of you. In the process, we look forward to investing and working alongside some of you to build the next generation of companies that address these exciting areas of innovation.

Send us an email or connect with us on Linked In (all contact info is in our bios which are linked above).