A Reminder: Home Prices Always Rise Over Time

Happy New Year All!.

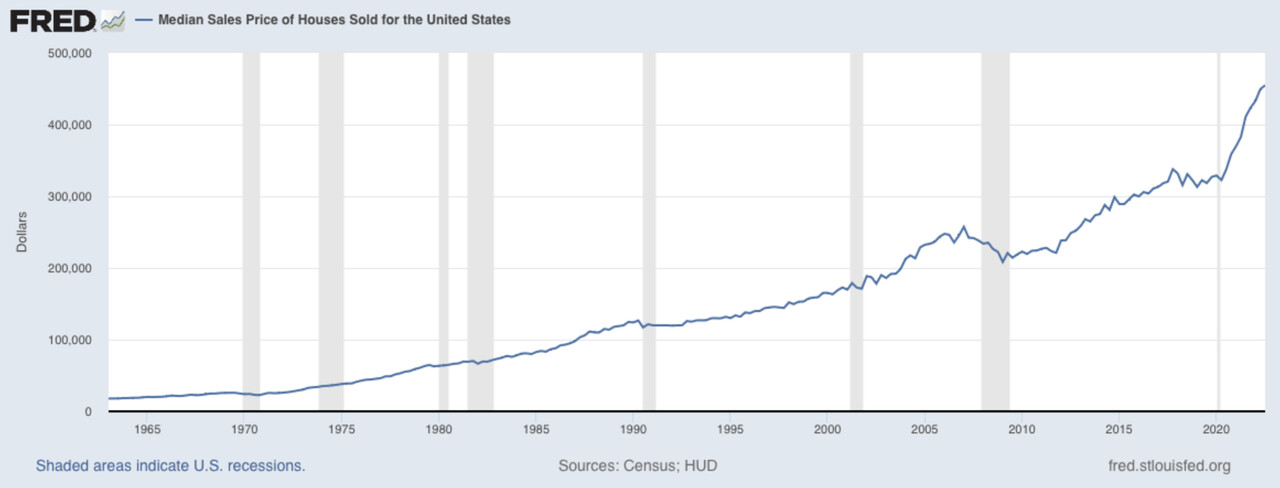

As we enter 2023 I think it’s important to continue our focus on perspective. The image I published at the top of this piece is from FRED (Federal Reserve of St Louis). It shows the median price of homes in the United States going back to 1960. In the five decades and through eight recessions since, home prices have only gone up.

Look at the period post great recession of 2008. Even though it was the worst recession since the Great Depression of 1929 home prices not only recovered but continued growing.

Think about this. Through multiple recessions, the oil patch crisis, the dot com recession, the Great Recession…all of them….home prices only go up over time.

So as we head into 2023, my theme is this: Betting on housing is a losers game. Stop wondering what will happen in the next six months and look at this market as the opportunity that it is. For the first time in many years potential homebuyers can now bargain a bit for their purchase. And yes, some markets still are too hot and remain a sellers market, while others are softer and pose options for buyers. But make no misstake about it, this market is on the verge of recovery.

The MBA forecasts a soft 1st quarter but expects home values to rise in the second half of 2023 and even more in 2024 and 2025. I agree with this view. In fact the moment Powell says that QT (quantitative tightening) is over rates will fall and demand will rise.

So be advised…..this may be the one and only window for the next few years to get into a buyers market. And remember…..as the Federal Reserve data shows….home prices only go up and always recover from recessions no matter how mild or severe.

Long term homeowners should view this market….right now…..as a unique buying opportunity.

Real Estate Appraiser at Tri-State Home Inspections

1yThank you for keeping the perspective real!

Sales Account Manager

1yHello David, it's a small world, I have worked in the mortgage industry with refinancing and HELOCs, qualifying candidates with Freddie Mac, Fannie Mae loans. I recently stepped out of my sale profession about six years ago to have necessary procedures done. I've worked long and hard to be full speed with things. I don't know if you are looking for good employee or know someone, because I am currently looking in the job market to go back to work. I found you on LinkedIn, but you can contact me at my email address at tludz1@gmail.com. Please send me your contact information, I will respond to you as soon as I have your email or phone number.

Realtor at Long Realty The FOX Group

1yThank you for your contributions. Your insights based on experience are invaluable. I compiled & analyzed a vast amount of data on housing market to quantify the "shortage" & identify several statistical correlations to US home prices. They suggest an outlook for home prices that mirrors yours. While all media focus has been on the RATE at which ownership costs have risen, there has been no mention that ownership costs (as % of income) hit an ALL-TIME LOW in 2020. That's precarious for an undersupplied market, and I expect is a factor driving the Fed's aggressive stance. A homeowner population locked in at historically low ownership costs leaves significant discretionary income to spend chasing limited goods & services and stimulate inflation. While I am suspect you are familiar with much of what I have, I think you might find some of the granular detail in my prospectus (for lack of a better term) & correlations interesting & useful. IF so, I would be honored to connect directly. Regardless, thank you for your contributions and Happy New Year! John Avery Phoenix, AZ

Vice President Sales and Education at American Reporting Company

1yThank you David for bringing some balance and perspective to the conversation.