The economic disruption caused by COVID-19 and the efforts to contain it will trigger a new cycle of rising defaults and losses in the commercial real estate lending sector.

To gauge the impacts of the COVID-19 disruption, Trepp has applied an economic and real estate forecast scenario to a portfolio of 12,500 commercial real estate loans. Trepp provides databases of securitized mortgages as well as The loans are from Trepp’s T-ALLR data set, which is comprised of balance sheet loans held by commercial banks.

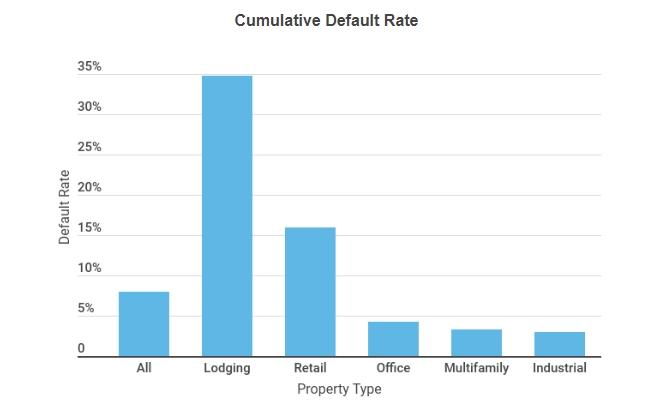

In the scenario presented in the report, the cumulative default rate across commercial mortgages overall will rise to 8%, up significantly from the current 0.4% default rate. The effect will be immediate and severe in the lodging sector, with a cumulative default rate approaching 35%.

Current Issue - April 2024

Current Issue - April 2024