This analysis is by Bloomberg Intelligence Senior Industry Analyst Matthew Kanterman and Bloomberg Intelligence Industry Analyst Nathan Naidu. It appeared first on the Bloomberg Terminal.

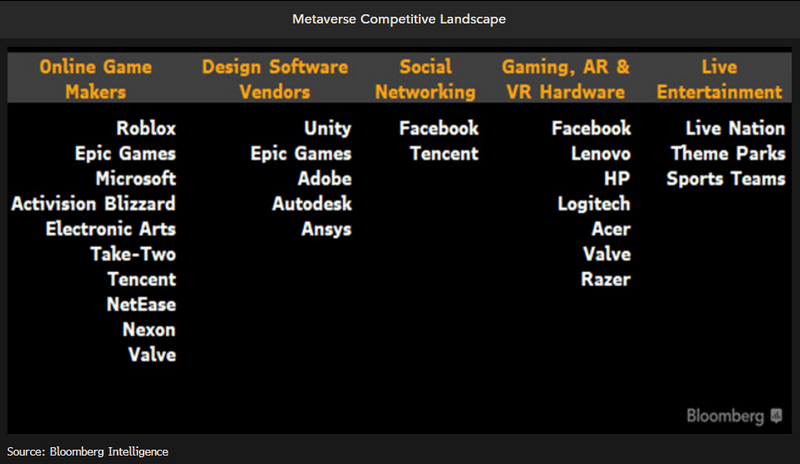

The metaverse is the next big technology platform, attracting online game makers, social networks and other technology leaders to capture a slice of what we calculate to be a nearly $800 billion market opportunity. Social, persistent, shared, virtual 3D worlds, the metaverse is the convergence of the physical and digital realms in the next evolution of the internet and social networks using real-time 3D software. It presents an opportunity for leading online entertainment and social media companies to capitalize on new revenue streams.

We’ve constructed a global metaverse theme basket to track the companies most exposed across industries. To be included, members must expect to generate a meaningful portion of revenue from platforms, experiences and transactions in virtual reality.

Metaverse could approach $800 billion tackling live events, ads

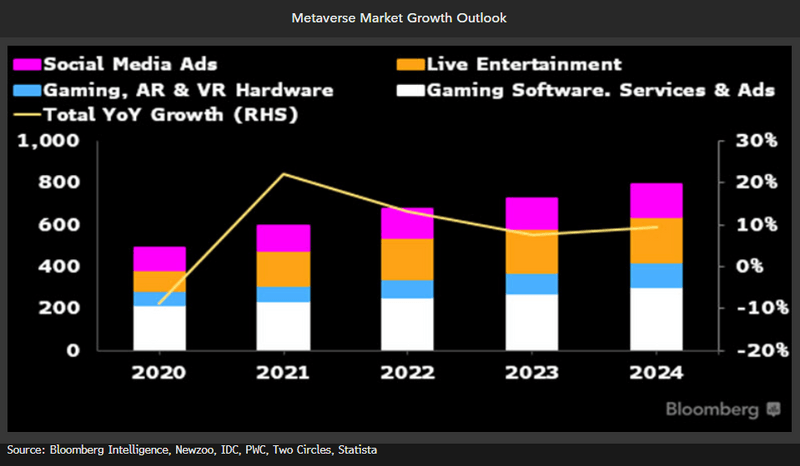

The global Metaverse revenue opportunity could approach $800 billion in 2024 vs. about $500 billion in 2020, based on our analysis and Newzoo, IDC, PWC, Statista and Two Circles data. The primary market for online game makers and gaming hardware may exceed $400 billion in 2024 while opportunities in live entertainment and social media make up the remainder.

Path to $800 billion on double-digit growth

The Metaverse market may reach $783.3 billion in 2024 vs. $478.7 billion in 2020 representing a compound annual growth rate of 13.1%, based on our analysis and Newzoo, IDC, PWC, Statista and Two Circles data. As video game makers continue to elevate existing titles into 3D online worlds that better resemble social networks, their market opportunity can expand to encapsulate live entertainment such as concerts and sports events as well as fighting for a share of social-media advertising revenue. The total Metaverse market size may reach 2.7x that of just gaming software, services and advertising revenue.

Online game makers including Roblox, Microsoft, Activision Blizzard, Electronic Arts, Take-Two, Tencent, NetEase and Nexon may boost engagement and sales by capitalizing on the growth of 3D virtual worlds.

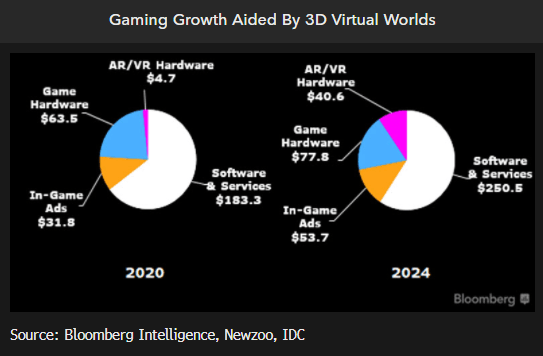

Gaming, AR, VR create $413 billion primary market

The primary Metaverse revenue opportunity for video-game makers consists largely of existing gaming software and services market as well as rising sales of gaming hardware, based on our analysis. Within this primary market opportunity that may reach $412.9 billion in 2024 vs. $274.9 billion in 2020, software and services revenue as well as in-game advertising revenue accounts for about 70% of the total market size. Although this is the existing market for online game makers, those that are successful in capturing a higher share of users and engagement through the elevation of existing games into virtual worlds can garner a higher share of sector sales.

Gaming hardware, including gaming PCs and peripherals and AR/VR hardware such as Facebook’s Oculus, accounts for the remainder of the primary market opportunity.

Live events, social ads can double market

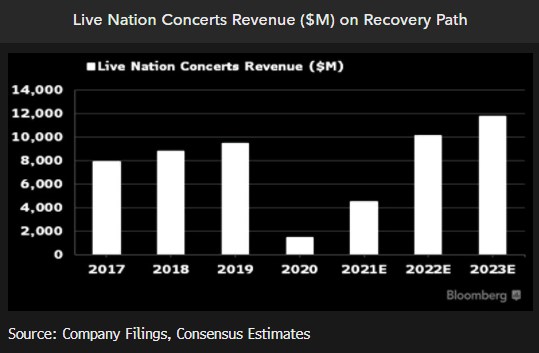

The ability to bring live events such as concerts, film showings and sports into 3D virtual worlds represent additional opportunities for game makers as they elevate online experiences into 3D social worlds to capitalize on the Metaverse opportunity. Game makers including Epic Games and Roblox have hosted concerts inside of their games already, while Unity is investing in opportunities to bring live sports content and tools into its 3D development kit.

Revenue from live entertainment businesses that can become part of the Metaverse concept – films, live music and sports – may exceed $200 billion in 2024, roughly flat vs. 2019, as these businesses slowly recover from the Covid-19 pandemic, based on our analysis and data from PWC, Statista and Two Circles.

Online game makers, social networks vie for metaverse leadership

Online game makers and existing social networks may vie for leadership of the burgeoning $800 billion Metaverse economy, on the convergence of megatrends of games, social and user-generated content. Facebook’s user scale and VR investments could give it an edge as the market develops, while game engine vendors Unity and Epic may see heightened software demand.

Roblox, Epic leading but virtual worlds aplenty

Roblox, Microsoft’s Minecraft and Epic Games’ Fortnite appear to be early leaders in the race for Metaverse leadership but there’s ample time for other game makers and social networking companies to tweak existing services or launch new ones to capitalize on the market’s growth. Other game makers have been able to attract large, active user bases in online titles such as Activision’s Call of Duty Warzone and World of Warcraft, EA’s the Sims, Take-Two’s GTA Online and Nexon’s MapleStory and Dungeon&Fighter Online. These companies could seek to add additional social features and make user-generated content to become a larger part of their experiences to capture Metaverse demand.

Games that successfully pivot towards virtual 3D worlds can capture a greater share of engagement and user growth, accelerating sales growth.