Inflation, Part 3: What Is the Fed’s Current Goal? Has the Fed Met Its Inflation Mandate?

The Federal Reserve is congressionally mandated to "promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates."1 This directive is often referred to as the Fed's "dual mandate," since accomplishing the first two goals makes the third achievable. Today, with the unemployment rate at a historically low level and inflation higher than it has been in decades, it seems worth reviewing that second goal a little further.

Defining Price Stability

Historically, central bankers have defined "price stability" as persistently low, or near zero, inflation. The emphasis on "persistence" makes future nominal values more predictable, which is very important for long-term nominal contracts between parties—such as corporate bonds, wage contracts, real estate rents, and mortgages—allowing those parties to anticipate the real value of future currency exchanges.2 The emphasis on "low" inflation means short-term deviations due to shocks, as can occur for energy or food prices, have a small effect on spending.

As our previous essays on inflation (Part 1 and Part 2)3 have shown, measuring inflation is a complex job, requiring many decisions and assumptions—and that's leaving aside the question of how much inflation, exactly, is acceptable in that "low to zero" range. Throughout the 1990s and 2000s, Fed policymakers disagreed about what price indexes and inflation rates they should prefer, and whether or not they should publicly "target" anything.4 Only in January 2012 did members of the Fed's Federal Open Market Committee (FOMC) announce a 2% inflation target based on the headline personal consumption expenditures (PCE) price index.5 The Fed targets PCE instead of the more familiar consumer price index (CPI) because it better captures consumption patterns, covers more expenditures, and is improved and standardized over time.6

Over the years, the 2% inflation target has become an international standard across central banks around the globe—adopted in slightly different terms in Canada, the United Kingdom, Japan, and elsewhere. Such a target can be justified in many ways. From a technical angle, most price indexes have a positive bias—2% inflation likely reflects lower "true" inflation. A nonzero inflation target also lets the Fed set "neutral" nominal interest rates higher than it could with no inflation; this gives the Fed more room to cut rates when it wants to stimulate the economy.7 Setting a nonzero inflation target also limits the chance of negative inflation (deflation), which could have serious economic consequences.8

Importantly, Fed policymakers believe that setting a credible inflation target—any target—is beneficial, since individuals can make more effective economic decisions if they can predict future price changes. This predictability is one reason the Fed cares about the inflation expectations of economic agents.

Targeting Inflation: The Fed's Record

Quantifying the Fed's record for hitting its target can be conceptually difficult. For one thing, do we care about (i) annualized inflation being close to 2% over some time period, or (ii) how many months year-to-year inflation is close to 2%? Our answer can have serious ramifications on policymaking; for instance, if several years have passed with inflation close to but below the 2% target, should policymakers aim for inflation above the target to average out over time, or should they let bygones be bygones and keep inflation close to the target?

Historically, the Fed preferred the latter option; past misses were in the past. But in August 2020, having failed to hit the target for more than a decade, it changed its approach.9 The "Statement on Longer-Run Goals and Monetary Policy Strategy"10 was revised, stating that the Fed would and should target average inflation "over time" and thus aim for higher inflation in the near-term future because inflation over the previous decade had typically remained below 2%.

Figure 1 shows the evolution of the PCE index since 1995. The choice of the period reflects the Fed's inflation-targeting history characterized by three important events: (i) the Fed's initial step toward inflation targeting with its internal, temporary, and nonspecific goal of 2% inflation in July 1996 during the Greenspan era; (ii) the announcement of a new 2% PCE inflation target in January 2012; and (iii) the revised policy framework announced in August 2020.11 The figure also plots a hypothetical PCE index if PCE inflation had been 2% since July 1996: The annualized inflation over the first period (1.99%) was much closer to 2% PCE than it was over the second (1.35%) or third (5.73%) periods. So, in fact, the Fed was more successful in hitting its 2% target before announcing that target.

With this historical perspective, the increase in inflation post-pandemic could be rationalized by some critics as accomplishing the Fed's new focus on average inflation over time. After more than a decade of missing the 2% trend, the current high readings of inflation have only recently—and barely—pushed prices above where they "should" have been if the Fed had consistently hit its target.12 Obviously, however, the Fed clearly has not viewed the inflation surge as a positive development, seeing the broad acceleration in prices as seriously disruptive and far from meeting its mandate.

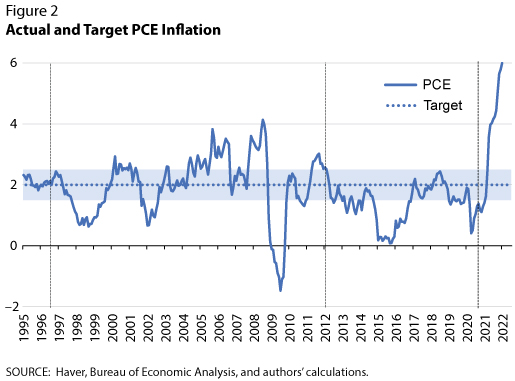

Another way to quantify the Fed's track record is shown in Figure 2, which plots monthly year-to-year PCE inflation by period. A 1% band around the 2% target is highlighted. Inflation was between 1.5% and 2.5% only 39.25% of the time over the first period, compared with 49.51% over the second—and a stark 9.09% so far over the third. By this calculation, then, the Fed did a good job keeping inflation stable and close to (if not exactly at) its inflation target until the recent inflation spike. Indeed, before the pandemic, the decline in inflation volatility after the Fed announced its initial target was one of the great success stories of inflation targeting.

Notes

1 Board of Governors of the Federal Reserve System (BOG) (2021).

2 For more details on the impact of inflation and the real effects in the presence of long-term nominal contracts, see Garriga, Kydland, and Sustek (2017).

3 Garriga and Werner (2022a,b).

4 Shapiro and Wilson (2019).

5 The FOMC had discussed setting similar targets since the 1990s: In its oft-cited July 1996 meeting, members agreed to a 2% inflation target of some kind but did not settle on what index to use or define it as a permanent goal. Consensus was achieved slowly, as FOMC members either changed or changed their minds (Shapiro and Wilson, 2019) Still, many analysts—including current St. Louis Fed President James Bullard—argue the FOMC had an implicit inflation target close to 2% PCE inflation by the mid-1990s (Bullard, 2018).

6 BOG (2000). Historically, inflation estimates using other indices tend to be very similar, as discussed in our recent essay (Garriga and Werner, 2022b).

7 This concern has become especially salient during the past two recessions, when the Fed lowered interest rates to 0%—the lowest it could go without setting negative interest rates, which the Fed wants to avoid for various reasons.

8 See Federal Reserve Bank of San Francisco (2003).

9 BOG (2020).

10 BOG (2022).

11 BOG (1996); BOG (2012); and BOG (2020).

12 Figure 1 shows the 2% trend starting in July 1996, but results would be very similar if we started the trend in January 2012, since (as explained) actual annualized inflation from July 1996 to January 2012 was close to 2%.

References

Board of Governors of the Federal Reserve System. "FOMC Meeting Transcript." July 2-3, 1996; https://www.federalreserve.gov/monetarypolicy/files/FOMC19960703meeting.pdf.

Board of Governors of the Federal Reserve System. "Statement on Longer-Run Goals and Monetary Policy Strategy." January 24, 2012.

Board of Governors of the Federal Reserve System. "Monetary Policy Report to the Congress Pursuant to the Full Employment and Balanced Growth Act of 1978." February 17, 2000; https://www.federalreserve.gov/boarddocs/hh/2000/february/fullreport.pdf.

Board of Governors of the Federal Reserve System. "Statement on Longer-Run Goals and Monetary Policy Strategy." August 27, 2020.

Board of Governors of the Federal Reserve System. "Monetary Policy: What Are Its Goals? How Does It Work?" Last update: July 29, 2021; https://www.federalreserve.gov/monetarypolicy/monetary-policy-what-are-its-goals-how-does-it-work.htm#:~:text=The%20Federal%20Reserve%20Act%20mandates,for%20monetary%20policy%20is%20commonly.

Board of Governors of the Federal Reserve System. "Statement on Longer-Run Goals and Monetary Policy Strategy." January 25, 2022.

Bullard, James. "What is the Best Strategy for Extending the U.S. Economy's Expansion?" CFA Society Chicago Distinguished Speaker Series Breakfast, September 12, 2018; https://www.stlouisfed.org/-/media/project/frbstl/stlouisfed/files/pdfs/bullard/remarks/2018/bullard_cfa_chicago_12_sept_2018.pdf.

Federal Reserve Bank of San Francisco. "What Is Deflation, What Are the Risks of Deflation, and How Can the Fed Combat Deflation?" Publications, May 2003; https://www.frbsf.org/education/publications/doctor-econ/2003/may/deflation-risks/.

Garriga, Carlos; Kydland, Finn and Sustek, Roman. "Mortgages and Monetary Policy." Review of Financial Studies, 2017, 30(10), pp. 3337-75.

Garriga, Carlos and Werner, Devin. "Inflation, Part I: What Is It, Exactly?" Economic Synopses, 2022a, No. 15; https://research.stlouisfed.org/publications/economic-synopses/2022/06/21/inflation-part-1-what-is-it-exactly.

Garriga, Carlos and Werner, Devin. "Inflation, Part II: How Do We Construct and Choose an Index?" Economic Synopses, 2022b, No. 16; https://research.stlouisfed.org/publications/economic-synopses/2022/06/22/inflation-part-2-how-do-we-construct-and-choose-an-index.

Shapiro, Adam and Wilson, Daniel. "The Evolution of the FOMC's Explicit Inflation Target." Federal Reserve Bank of San Francisco Economic Letter, April 15, 2019; https://www.frbsf.org/economic-research/publications/economic-letter/2019/april/evolution-of-fomc-explicit-inflation-target/.

© 2022, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed