Breaking News:

How Energy Investors Should Read The Fed’s Latest Notes

After another bout of intensive…

Oil Exports or Carbon Credits: The Global South’s Dilemma

Asking developong nations to stop…

WTI Spikes On Large Draw In Gasoline Inventories

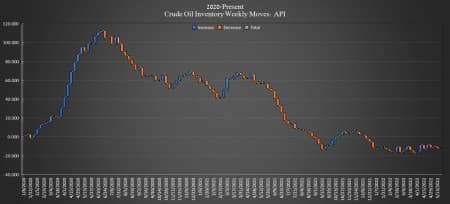

The American Petroleum Institute (API) reported a small build this week for crude oil of 567,000 barrels.

The draw comes even as the Department of Energy released 6 million barrels from the Strategic Petroleum Reserves in Week Ending May 20.

U.S. crude inventories have shed some 75 million barrels since the start of 2021 and about 18 million barrels since the start of 2020, according to API data.

In the week prior, the API reported a draw in crude oil inventories of 2.445 million barrels after analysts had predicted a build of 1.533 million barrels.

Oil prices had a modicum of calm on Tuesday, with WTI trading flat with 0% movement from Monday at $110.30 per barrel on the day at 11:21 a.m. ET—down roughly $4.50 per barrel on the week. Brent crude was trading up 0.20% on the day at $113.70—and down nearly $1 per barrel on the week, with the spread between the two benchmarks now completely evaporated.

U.S. crude oil production rose to 11.9 million bpd in the week ending May 13. Crude production in the United States is down 1.2 million barrels per day from pre-pandemic times.

This week, the API reported a large draw in gasoline inventories of 4.223 million barrels for the week ending May 20—on top of the previous week's 5.102-million-barrel draw.

Distillate stocks also saw a draw in inventory, of 949,000 barrels for the week compared to last week's 1.075-million-barrel increase.

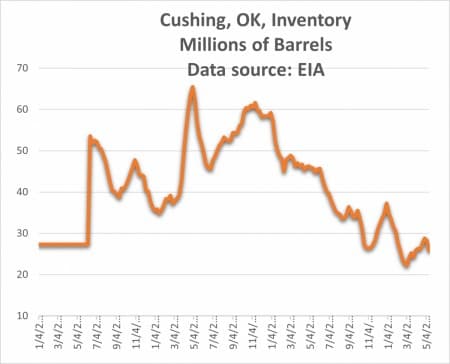

Cushing saw a 731,000-barrel draw this week. Cushing inventories crashed to 25.839 million barrels in the week prior, as of May 13, according to EIA data—down from 59.2 million barrels at the start of 2021, and down from 37.3 million barrels at the end of 2021.

ADVERTISEMENT

At 4:36 pm, ET, WTI was trading down at $109.80 (-0.41%), with Brent trading up at $113.50 (+0.05%).

By Julianne Geiger for Oilprice.com

More Top Reads from Oilprice.com:

- Biden Could Tap Diesel Reserve In A Bid To Ease Fuel Crunch

- Oil Markets Are Bracing For A Slew Of Bullish News

- World Sees First Global Energy Shock: World Energy Council

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B