Breaking News:

OPEC Expects Solid Global Oil Demand This Summer

OPEC expects strong oil in…

Breakthrough Paper-Based Battery Design Draws Inspiration from Plants

Researchers at Tohoku University have…

Oil Prices Dip On Small Crude, Gasoline Inventory Build

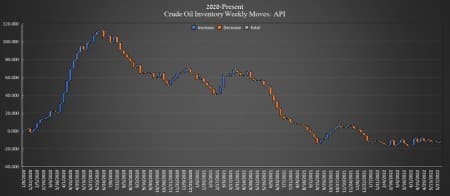

The American Petroleum Institute (API) reported a build this week for crude oil of 1.845 million barrels, while analysts predicted a draw of 1.8 million barrels.

The draw comes even as the Department of Energy released 7.3 million barrels from the Strategic Petroleum Reserves in Week Ending June 3.

U.S. crude inventories have shed some 74 million barrels since the start of 2021 and about 17 million barrels since the start of 2020, according to API data.

In the week prior, the API reported a draw in crude oil inventories of 1.181 million barrels after analysts had predicted a draw of 67,000 barrels.

Oil prices rose on Tuesday, with major banks earlier in the week increasing their oil price predictions for the remainder of the year. WTI was trading up 1.33% on Monday at $120.10 per barrel on the day minutes before data release—up almost $5.50 per barrel on the week. Brent crude was trading up 1.34% on the day at $121.10—and up nearly $6 per barrel on the week.

U.S. crude oil production stagnated at 11.9 million bpd for the third week in a row for the week ending May 27. Crude production in the United States is down 1.2 million barrels per day from pre-pandemic times.

This week, the API reported a build in gasoline inventories of 1.821 million barrels for the week ending June 3, on top of the previous week's 256,000-barrel draw.

Distillate stocks saw a rise in inventory, of 3.376 million barrels for the week, compared to last week's 858,000-million-barrel increase.

ADVERTISEMENT

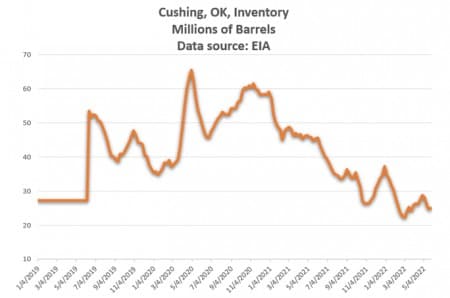

Cushing saw a decrease of 1.839 million barrels this week. Cushing inventories rose to 25.034 million barrels in the week prior, as of May 27, according to EIA data—down from 59.2 million barrels at the start of 2021, and down from 37.3 million barrels at the end of 2021.

At 4:37 pm, ET, WTI was trading up at $120 (+1.24%), with Brent trading up at $121 (+1.28%).

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- New Drilling Stalls Out In The U.S. Oil Patch

- Noway's Offshore Oil Workers Threaten To Strike

- More Iranian Crude May Be Coming To World Markets

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B