Home Buyer & Seller Tips As 2022 Mortgage Rates Spike Over 7%

This post originally appeared on The Basis Point: Home Buyer & Seller Tips As 2022 Mortgage Rates Spike Over 7%

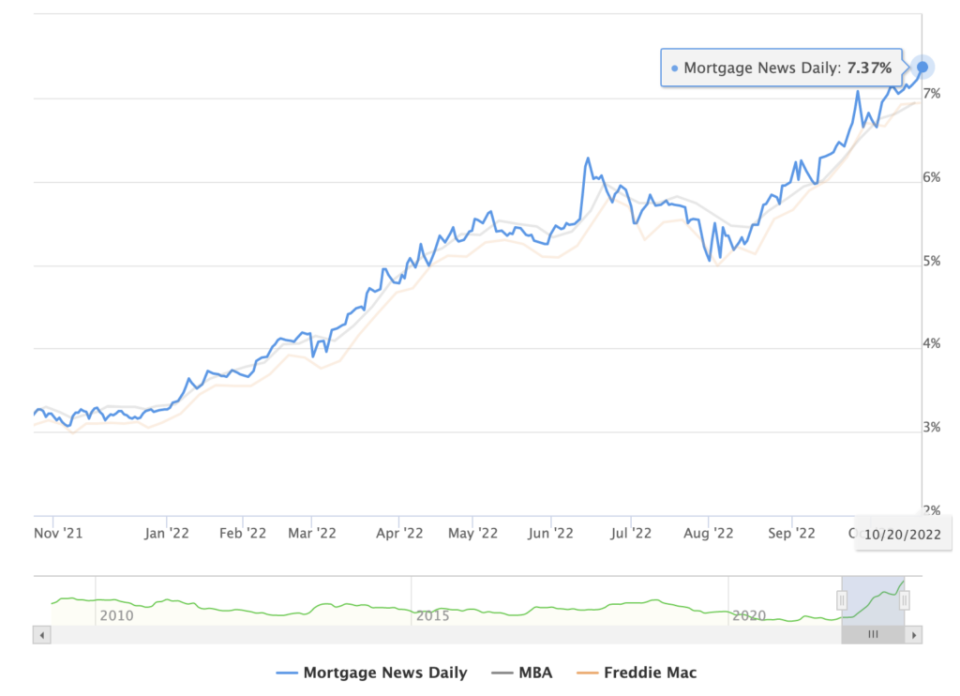

The primary source for mortgage rate headlines is a weekly rate survey released by Freddie Mac on Thursdays. Today it came out at 6.94% with 0.9% in points. This means you’d get below 7% if you paid almost 1% of your loan amount as an up front fee at closing in addition to normal closing costs. If you don’t pay this fee, mortgage rates are over 7% now.

Plus this Freddie Mac survey looks back on the previous week leading up to each Thursday. And the mortgage bond market — which is how the rates you get from lenders are priced daily — has sold off sharply in the past few days. Rates rise when bond prices drop in a selloff, so rates closed trading today at about 7.375% with no points.

The rough year for rates continues. There will be a turning point, but not before we see the November 1 and December 14 Fed rate policy decisions as well as Core PCE Inflation — the Fed’s preferred inflation measure — next Friday (ahead of the November 1 meeting).

Part of the issue is bond markets believe the Fed will maintain its highly aggressive rate policy because last week’s September Core CPI Inflation number peaked at 6.6%.

If Core PCE inflation does the same, it’ll validate another big 75 basis point hike even more, and bond markets are getting ahead of that now.

This is having the Fed’s intended effect of home sales slowing eight straight months, which has led to home price appreciation slowing in many local markets, and home prices declining in many other local markets.

For home buyers this means that, while you’ll have to take a 7% mortgage rate now, you finally don’t have to pay nosebleed prices for homes. It’s easy to refi into a lower rate a year or two from now when the Fed’s inflation battle has played out. It hasn’t been easy to get a decent price on a home in recent years, so you need to watch your local market closely to do your best (along with intel from your realtor and lender) to call the bottom in your desired neighborhoods. DO NOT FORGET: street and individual home level pricing is the only thing that matters. Headlines about prices mean nothing unless they’re referring to your exact target area. Bargain hunters always win in buyer’s markets.

For home sellers this means different things depending on the resilience of your market. If your area has had a huge run-up in home prices, then you’ve done well and might risk losing some of that upside if you wait too long to sell. In a case like this, if you plan to buy a new home in the same area, you might not want to buy right away. So one scenario is to sell and bank your equity now, rent for a period while you watch the market, then buy at as close to the bottom as you can (again, with help and intel from your realtor and lender on the ground in your area). If your area is more stable and your time horizon in any new home you buy after you sell is longer-term, then you might be fine to sell and buy now.

Home price factors are local while rate factors are national and global, so headlines about home prices mean very little for your decisions unless the stories are talking about your desired neighborhood.

As for mortgage rates at 7%, here’s more detail from my friend Matt Graham at MND on this week’s move.

Good luck out there, don’t let the headlines break your spirit, and please comment below, or reach out directly with questions.

___

Reference:

– Mortgage Rates Have Been Over 7% For a While–Easily as High as 7.375% Today

DO YOU LIKE MONEY? GET MORE AT THE BASIS POINT®

Court ruling may defund top consumer financial protection regulator, but doesn’t change laws

30-Year Mortgage Rate Spike In 2022 – Animated Chart

Why It’s Good That 60,000 Home Purchase Deals Cancelled Last Month