Debt ceiling: America's budget crisis of its own creation

Getty Images

Getty ImagesFire up the giant digital billboards with their ever-increasing dollar displays. Start calculating how much every American man, woman and child owes. Cue the comparisons to a family budget, or credit-card spending or running a small business.

The national debt - and the legally mandated cap on the amount of new debt the federal government can issue - are back in the headlines.

First, a bit of context. The US government is in the enviable position of being able to issue new debt pretty much whenever it wants. American Treasury securities have been viewed as one of the safest, most stable investments in the modern world. In times of economic turbulence, US debt is a harbour in the storm.

If the US issues new government debt in the form of Treasury bonds, bills, notes and securities, there will be investors, both in the US and abroad, who are interested buyers.

While the current figures for the US debt - $31tn (£25tn) and growing - are astounding in both numerical and comparative terms, they do not represent an impending crisis.

The US debt-to-gross-domestic-product ratio, typically a more illuminating measure of a nation's ability to manage its debt, sits at 128%.

This is lower than more than a dozen of countries, including Japan, Greece and Italy.

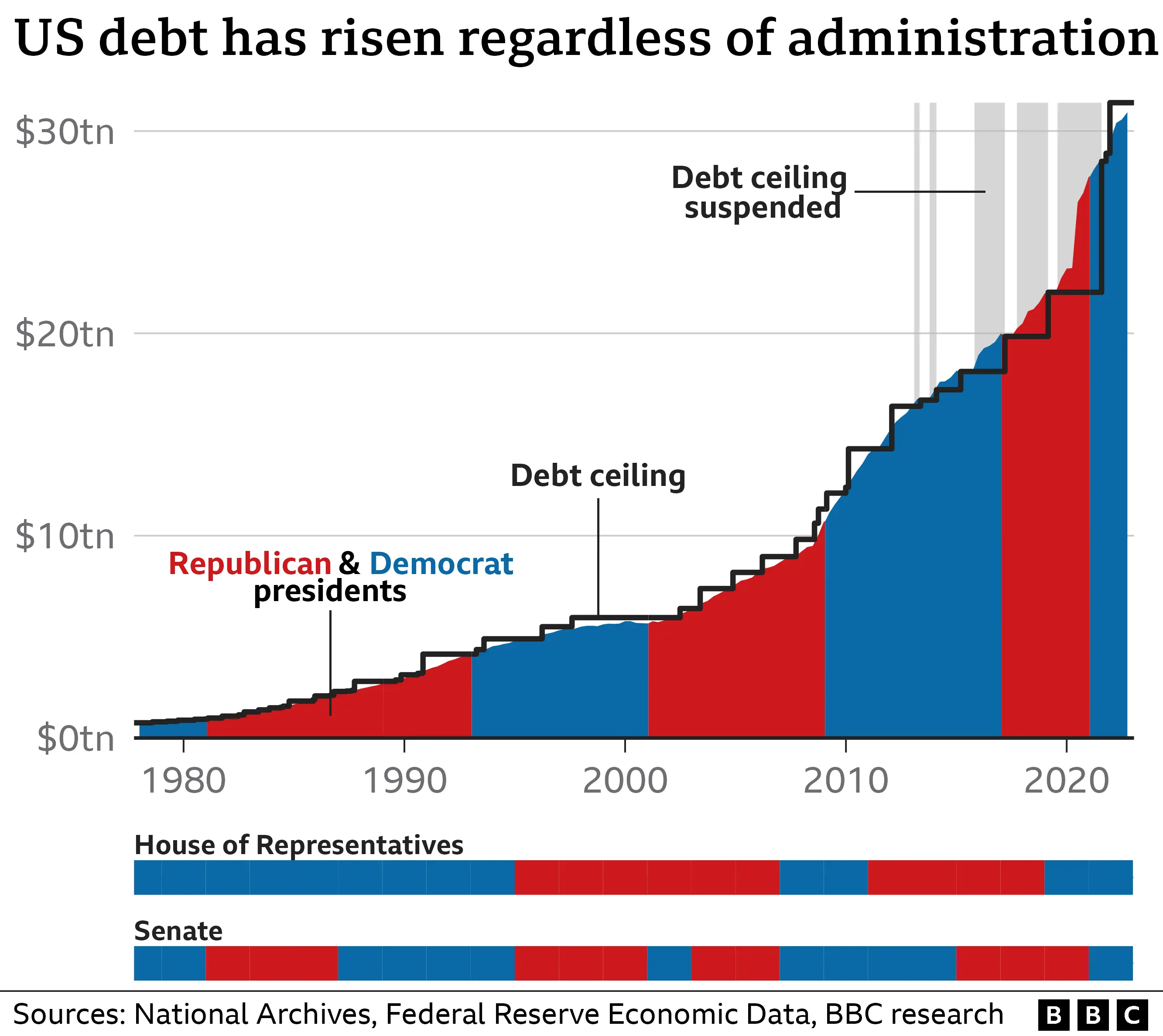

The dispute over the national debt, then, is not one of economics but of politics. Republicans are attempting to use a legal requirement that Congress set a cap on the amount of new debt the US Treasury can issue to force the White House and Democrats in the Senate to agree to sweeping spending cuts in exchange for an increase in the debt limit.

That debt limit cap was first instituted by Congress in 1917, but increasing the amount was a formality for nearly a century.

Republicans in 2011 first used the limit - and the threat of a US default on its debt obligations - to force then-President Barack Obama to the budget negotiating table.

Their efforts were somewhat successful, as Mr Obama and the Republicans agreed to caps on government spending.

Those caps were frequently ignored, however, and ultimately abandoned by the Republican-controlled Congress in 2018, which then increased discretionary spending by 16% (with the support of many Democrats).

In fact, Congress raised or waived the debt limit three times during Donald Trump's presidency, standing in contrast to the debt battles during his predecessor's time in office.

Now that a Democrat is back in the White House and one chamber of the Congress is in control of Republicans, the debt-limit battles have returned once again.

It's a political game of chicken, where the stakes are as high as the consequences are avoidable.