The fall usually marks the beginning of the school year, seasonally cooler weather and a seasonally cooler housing market. But, this year, the housing market’s typical autumn slowdown is more pronounced as rapidly rising interest rates discourage buyers and sellers from entering the market. The housing market is not immune to business cycles, and the current rising mortgage rate environment makes conditions difficult for the housing market. But there are fundamental and long-term drivers of housing demand that will position the housing market to rebound once the dust settles from the current challenging economic conditions. One of those drivers is education.

We’re often told that education is the key to a more secure financial future. Most people spend at least 12 years of their lives as students and even more if they pursue higher education. But does more education equate to increased earning potential? And, if so, does the increased earning potential translate to a greater likelihood of becoming a homeowner? If education is the key to a more secure financial future, and in turn homeownership, then millennials are on the right track.

“Millennials’ pursuit of higher education is good news for the housing market in the long run, because education is the key to unlock both greater earning power and, in turn, homeownership.”

Does More Education Equate to Higher Earnings?

The millennial generation, those between the ages of 25 and 40 in 2021, is the largest living adult generation. Many millennials are well into their careers, while others are still in school. According to our research, millennials are the most educated generation in American history.

Approximately 38 percent of millennials have a bachelor’s degree or higher, compared with 32 percent of Generation X and 15 percent of baby boomers when they were the same age. Millennials also earned their bachelor’s degrees much faster than previous generations. By their mid-40s, 30 percent of baby boomers had a bachelor’s degree or higher, Generation X reached that mark by their late 20s, but millennials achieved the same educational milestone by their mid-20s.

However, education takes time and money. Millennials have delayed key lifestyle decisions in favor of investing in the pursuit of education, pushing marriage and family formation to their early-to-mid-30s. Previous generations made these lifestyle choices in their 20s. Marriage and family formation are two of the most powerful motivations for homeownership, so these delayed lifestyle choices tend to also delay the desire for homeownership. However, when the time comes to become a homeowner, the earning power benefits of higher educational attainment are real.

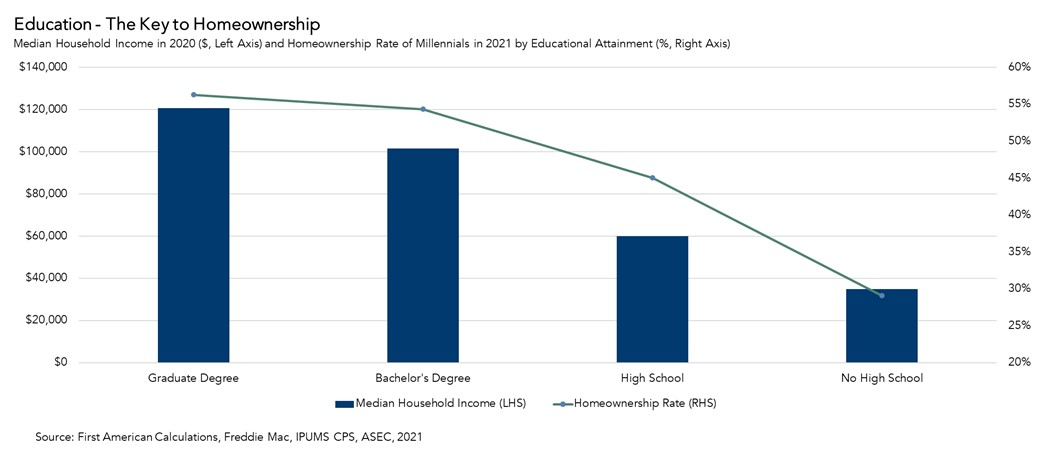

The Investment Pays Off

In 2020, millennials with a bachelor’s degree had a median household income of over $100,000, while those with at least a graduate degree had a median household income of over $120,000. Compare those income levels with the median household income of millennials with just a high school degree (or some college) of $60,000 and the earning power benefits of higher education are undeniable. The income difference is even more stark when compared with millennials with no high school degree, who have a median household income of $35,000, further underscoring the importance of and connection between educational achievement and earning power.

Higher household income has positive implications for house-buying power, and as it turns out, the likelihood of purchasing a home. The homeownership rate for millennials with a bachelor’s degree in 2021 was 9 percentage points higher than those with just a high school degree. Nevertheless, we know that millennials have a lower homeownership rate compared with their generational predecessors. At age 30, 42 percent of millennials owned homes, compared with 48 percent of Gen Xers at the same age. Yet, millennials have significantly narrowed this gap as they move into a new phase of their lives. At the same age of 40, the millennial homeownership rate is 60.3 percent, while Gen X stood at 63.5 percent.

The importance of education to homeownership continues to increase over time. The impact of educational attainment on the likelihood of homeownership has more than doubled in 20 years. In 2000, the difference in the homeownership rate between those with a high school degree and those with a college degree was 3.7 percentage point. By 2021, this gap more than doubled to 7.5 percentage points. Millennials pursuit of higher education is good news for the housing market in the long run, because education is the key to unlock both greater earning power and, in turn, homeownership.